Discover how electric vehicles are helping advance the global energy transition. While EVs produce significantly less CO2 emissions than conventional combustion vehicles, challenges such as high costs, limited charging infrastructure, and a volatile battery materials market persist. Continued investment and innovation in renewable energy and EV technologies are essential to meet climate goals.

The transportation sector is responsible for around one-sixth of global greenhouse gas emissions, according to the International Energy Agency (IEA). Conventional combustion vehicles that run on gasoline and diesel fuel rely heavily on fossil fuels, which release greenhouse gas emissions that affect the health of people and our planet.

A solution that has been revolutionizing the transportation industry in recent years is electric vehicles (hereby referred to as EVs). While EVs run on electricity and largely depend on fossil fuels for recharging, the CO2 emissions from driving EVs are significantly lower than combustion engine vehicles over their lifetime.

Despite the EV industry booming in recent years, EV uptake is slowing down. The high cost of EVs compared to conventional vehicles is still significant in many countries. Additionally, charging infrastructure and advanced technologies that can provide swift recharging speeds still have a long way to go.

How Can EVs Help the Global Energy Transition?

The transportation industry is affecting our environment and our health. The combustion of fossil fuels in Internal Combustion Engine (ICE) vehicles leads to the increase of PM2.5 (fine particles 2.5 microns or less in diameter) which pollutes our air.

These fine PM2.5 particles, if breathed in over time, can increase the risk of stroke, heart disease, lung disease, and cancer, according to the United Nations. In 2019, 99% of the world’s population were living in air pollution levels that did not meet the World Health Organization’s strictest guidelines.

According to the IEA, to remain on track to meet zero-emission targets by 2050, CO2 emissions from the transportation sector should aim to be reduced by more than 3% per year until 2030. Removing ICE vehicles from our roads and replacing them with EVs is going to be hugely important for the energy transition and reducing emissions globally.

How do Electric Vehicles Work?

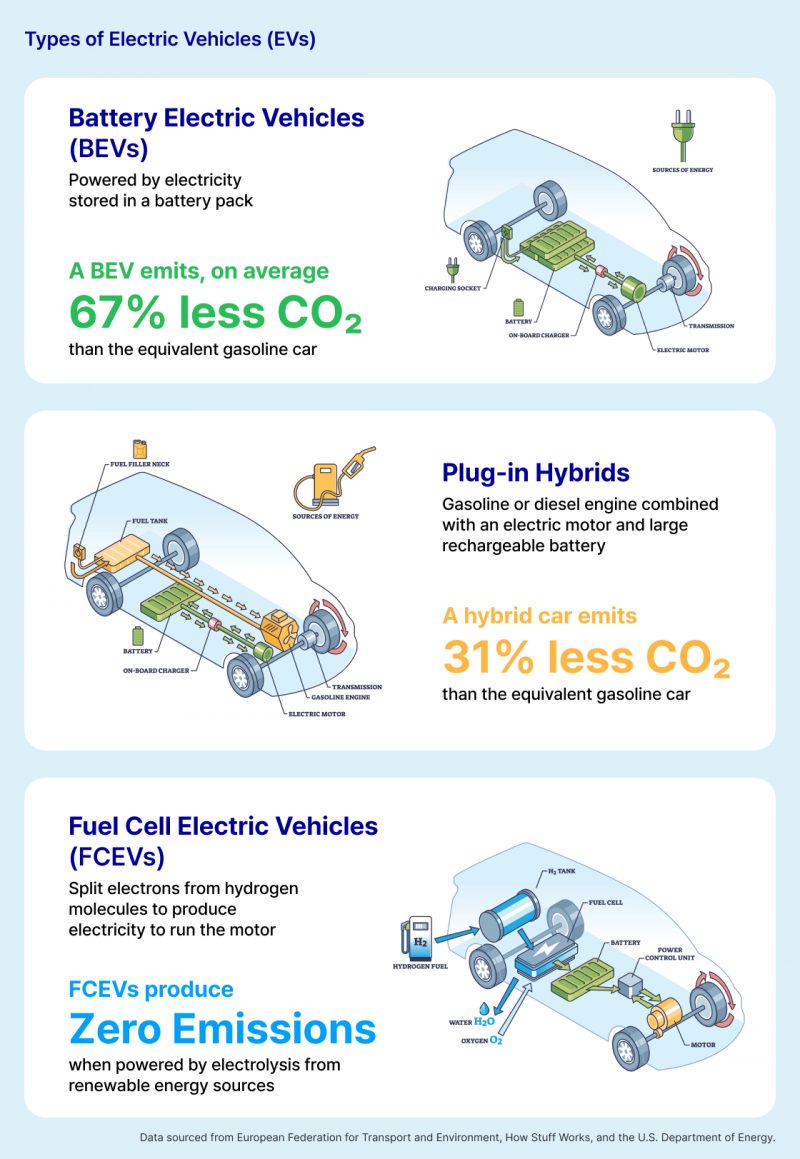

Electric vehicles, also referred to as Battery Electric Vehicles (BEVs), work the same way as conventional vehicles but have an electric motor instead of a combustion engine that requires fuel.

BEVs use their battery packs to power an electric motor, meaning they need to be plugged into an EV charger. BEVs do not emit exhaust while driving, meaning fewer greenhouse gases are emitted compared to ICE vehicles over their lifetime.

Are EVs Better for the Environment?

Many countries still rely on coal, natural gas, and oil to generate electricity. Therefore, the electricity used to charge EVs is largely still produced from fossil fuels. Until the adoption of renewable energy is more widespread, EVs will remain low-carbon vehicles, not zero-emission solutions.

Even when charged with electricity produced by fossil fuels, EVs emit less carbon emissions than ICE vehicles. According to the European Federation for Transport and Environment, EVs in Europe emit “more than 3 times less CO2” (roughly 67%) than equivalent gasoline cars. Furthermore, according to the United States Environmental Protection Agency, EVs produce less greenhouse gas emissions than ICE vehicles over their lifetime “even when accounting for manufacturing.”

Hydrogen Fuel Cell Electric Vehicles

Hydrogen-powered Fuel Cell Electric Vehicles (FCEVs) are vehicles that use hydrogen from fuel cells instead of batteries. Similar to BEVs, driving FCEVs does not emit harmful exhaust emissions. However, FCEVs are only considered zero-emission vehicles if the hydrogen used is produced by electrolysis from renewable sources, also known as green hydrogen. A 2024 report from McKinsey and Company indicates that most of the hydrogen consumed today is fossil fuel-based grey hydrogen, generated from natural gas or methane. Therefore, additional investment into green hydrogen is needed before FCEVs can be considered zero-emission vehicles.

FCEVs have not seen the same progress in sales as BEVs, making up only “0.2% of all low-emission vehicle sales.” However, FCEV technology shows promise in the heavy-trucking sector as their long-range is favorable for trucking long distances. One estimate predicts that hydrogen trucks could account for “19% of the zero-emission heavy-duty truck market in 2044”.

Three Factors Affecting the Switch to EVs

While global EV sales are booming, uptake is not happening as rapidly as expected. There are many factors that are keeping customers away from EVs, opting instead for conventional ICE vehicles.

1. The Cost of Electric Vehicles

In most markets, the cost to purchase an EV is still higher than conventional ICE vehicles. According to the IEA, EVs are still 10% to 50% more expensive than their combustion engine counterparts in some cases. The IEA also reported that in 2023, 55% to 95% of all electric car sales in major emerging and developing markets were models that are not affordable for customers with average household incomes. By contrast, in China, the IEA estimates that 60% of EVs sold in 2023 were already cheaper than their equivalent combustion engine vehicles.

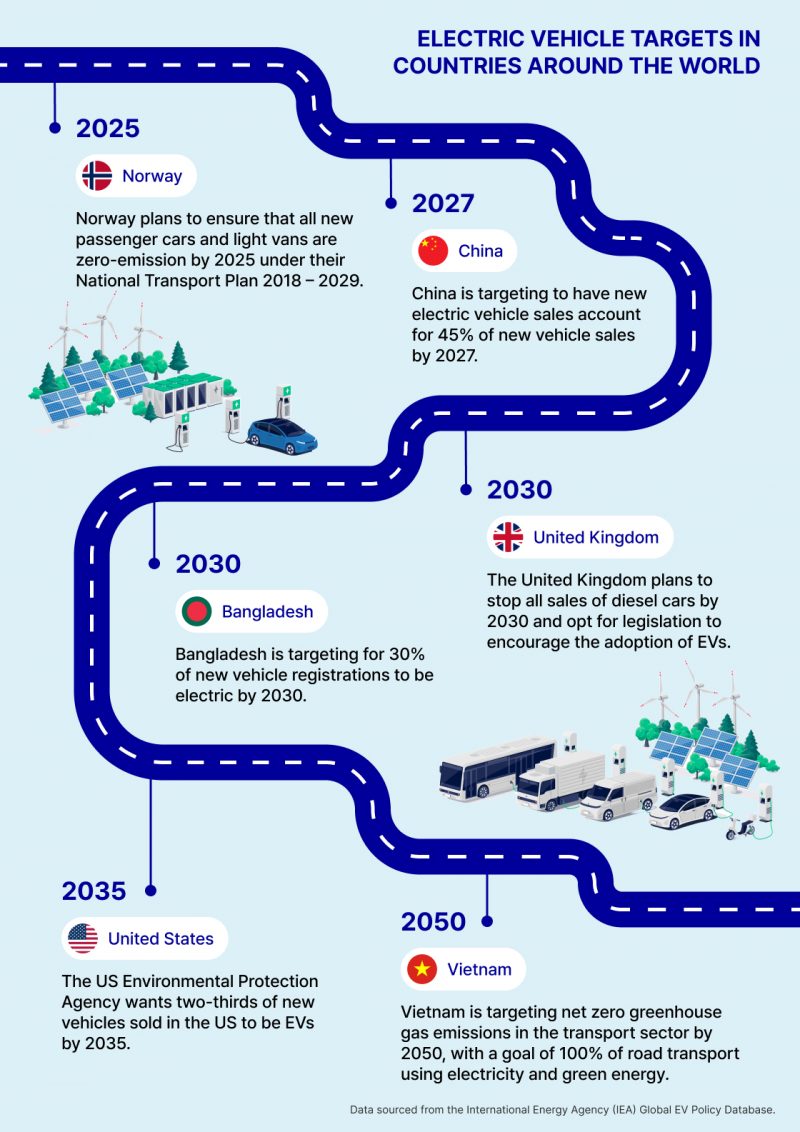

Countries around the world are setting national targets to increase EV numbers. The following image outlines a timeline of some of these policies based on data from the IEA’s database of global EV Policies.

2. Volatile Lithium-ion Battery Supply Chain

The cost to create the lithium-ion batteries used in EVs is expensive. Lithium-ion batteries are made using critical minerals such as lithium, cobalt and nickel.

In 2022, lithium-ion packs became 7% more expensive in 2021 due to volatile battery metal markets according to the IEA. Prices plummeted by 14% in 2023 due to slow growth in the EV market.

As history shows, the lithium-ion battery market and the supply chain of critical minerals is prone to uncertainty. Further technological advancement in battery manufacturing is needed to secure the battery market to create a more accessible EV market.

3. Unstable Charging Infrastructure

Unlike conventional ICE vehicles, EVs can be charged from the comfort of your own home, provided you have the space of course. For drivers who don’t have the space to install a new EV charger, public chargers are needed to ensure convenience and accessibility to EV drivers.

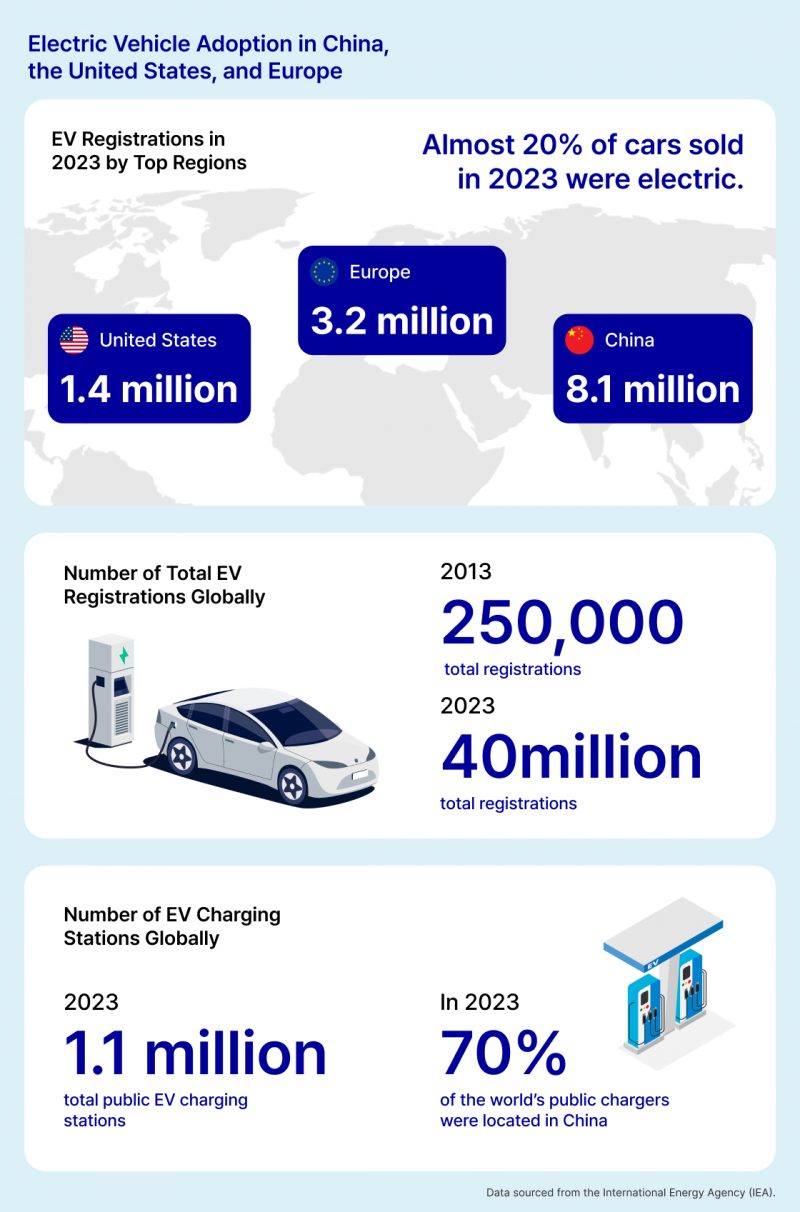

In 2023, a total of 1.1 million public EV charging stations were installed, a 40% increase compared to 2022 according to the IEA. At the end of 2023, roughly 70% of the world’s public chargers were located in China.

To ensure the EV ecosystem is accessible to more drivers, increased public charging infrastructure is needed. Many governments have plans in place to secure more public EV chargers to transition to cleaner transportation industries.

To progress in the global energy transition, we need to move away from our reliance on gasoline and diesel. More needs to be done to decrease CO2 emissions in the transportation sector. EVs are one solution helping decarbonize the vehicles on our roads. As the slow growth in the EV market shows, resolving cost and infrastructure issues will help speed up the success of EVs in the global energy transition.

The Uptake of Electric Vehicles in Europe, China, and the U.S.

The share of EVs in total passenger car sales is projected to grow by two to five times by 2030 according to a report by McKinsey and Company. By comparing the adoption of electric vehicles in the three major markets the U.S., Europe, and China, we can get a glimpse into the progress that they are making on a commercial scale towards the global energy transition.

Global Market Share of EV Registrations

According to the IEA’s Annual EV Outlook 2024, EV sales could potentially reach 17 million in 2024. In other words, by the end of this year, more than 20% of all cars sold around the world could be an EV. However, this would not be a large increase from 2023 where nearly one in five vehicles sold around the world was an EV.

When looking at total EV vehicle registrations in 2023, it is clear that EV sales are still concentrated in three main markets. Out of 14 million EV car sales in 2023, 95% of EVs were registered in China, Europe, and the U.S. 60% of new EV registrations were recorded in China, 25% in Europe, and 10% in the U.S. Despite the scale of EV adoption in these three key regions, the rest of the world has a lot of catching up to do.

Necessary Actions for Continued EV Growth

The road to net zero and decarbonization in the energy sector is a long and complicated one. Realistic targets are needed for expanding low-carbon transportation and energy solutions. Continued investment in renewable energy infrastructure will be key to the transition to low-carbon technologies. It will also be up to the automotive industry to ensure that the transition from ICE vehicles to EVs is an enjoyable experience for customers.

Samsung C&T T&I’s Strategic Diversification into EV Ventures

Samsung C&T Trading and Investment Group is providing EV charging infrastructure and solutions in North America to respond to the rapidly growing EV market, collaborating with specialized recycling partners to trade materials from used batteries. To provide sustainable solutions throughout the entire lifecycle of EVs, the T&I Group is actively involved in trading and recycling projects for raw materials essential to rechargable batteries, such as cobalt and nickel, with an emphasis on the EV market.

The T&I Group strives to enhance its corporate value and competitiveness in various renewable energy projects, establishing plans to increase investment and diversify its business operations.