- Global fertilizer demand continues to grow, with increased attention on efficient use and smart application

- Innovations in sourcing, production, and nutrient management are reshaping fertilizer strategies across markets

- Samsung C&T supports industry needs through flexible sourcing and long-standing experience in global fertilizer trade

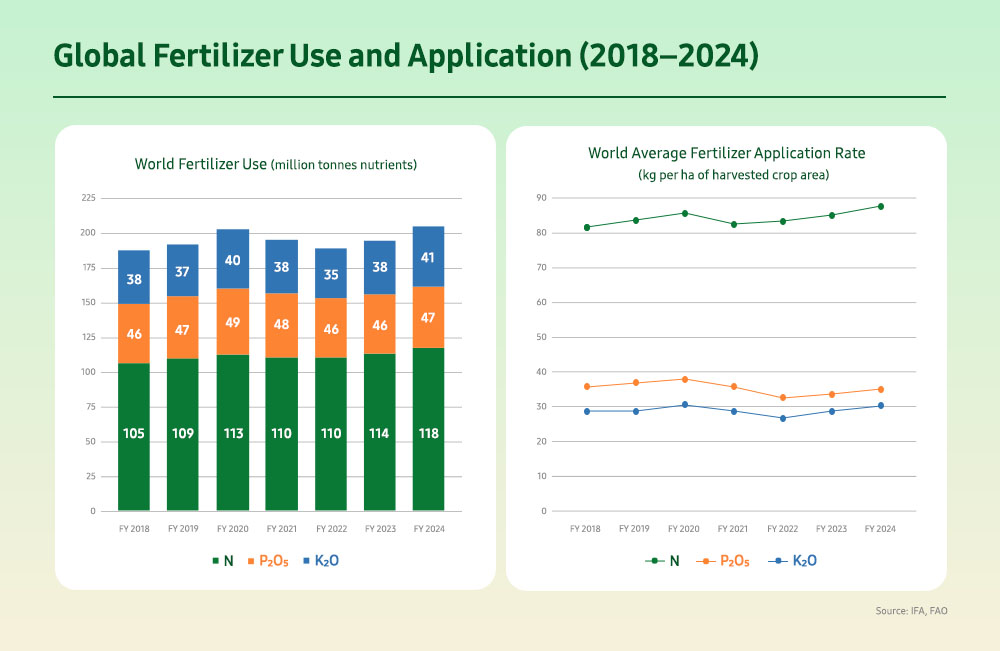

Fertilizer remains one of the most essential inputs for global agriculture, but the way it is used is gradually evolving. According to international outlooks, total fertilizer use is projected to increase steadily, yet at a slower pace than in previous decades. Global demand grew by over 17 million tonnes (Mt) of nutrients between 2022 and 2024, reaching approximately 206 Mt.

However, over the next five years, annual growth is expected to remain moderate, reflecting a broader shift toward more targeted and efficient application.

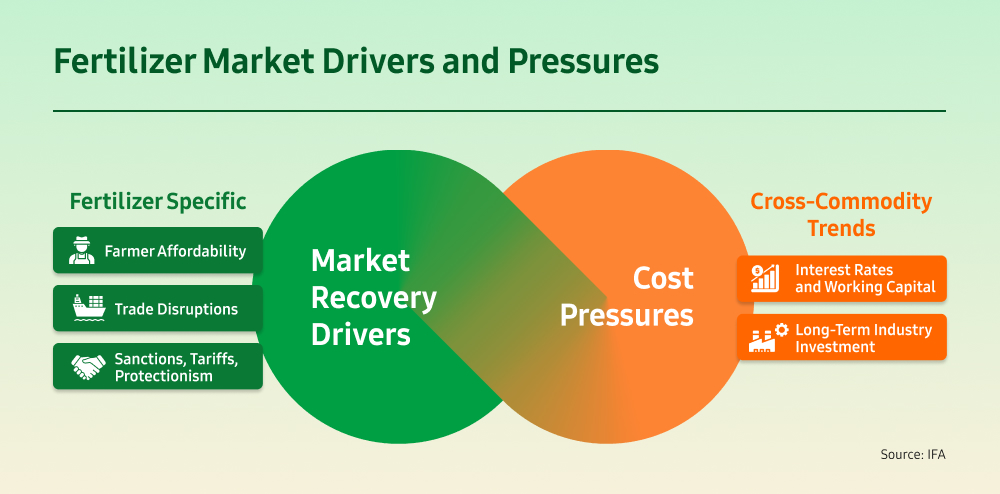

This trend is being shaped by various structural factors. Rising input costs, regulatory developments, and operational concerns such as runoff are encouraging both producers and consumers to pursue more effective fertilizer strategies. These shifts are not only influencing how fertilizer is produced, but also how it is applied in the field.

Targeted Inputs, Lower Impact

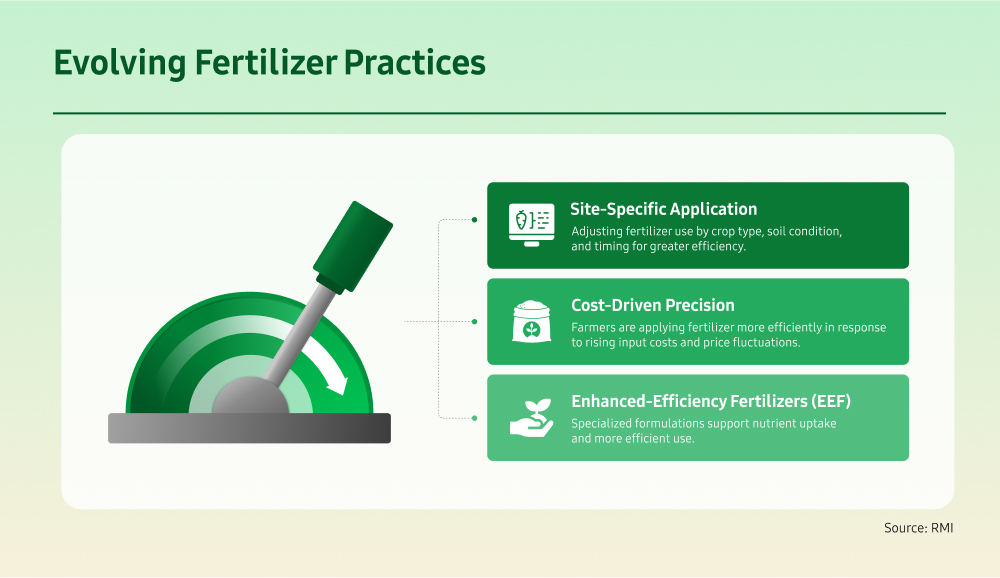

Fertilizer efficiency is becoming more tailored across agricultural regions as producers and farmers respond to both market needs and local regulations. In many countries, site-specific application techniques are gaining traction, adjusting fertilizer inputs based on crop type, soil condition, and timing to improve performance and resource efficiency.

Additionally, affordability and supply dynamics are influencing more precise fertilizer use. While average global application rates have returned to pre-2022 levels, usage trends vary by region and nutrient type. Nitrogen(N) use has seen steady recovery, while phosphate(P2O5) and potash(K2O) are growing at a slower pace due to cost considerations.

Producers are also introducing enhanced-efficiency fertilizers—formulations designed to improve nutrient uptake or release nutrients more slowly—supporting better yields with optimized input use.

Advancing Innovation in Fertilizer Production

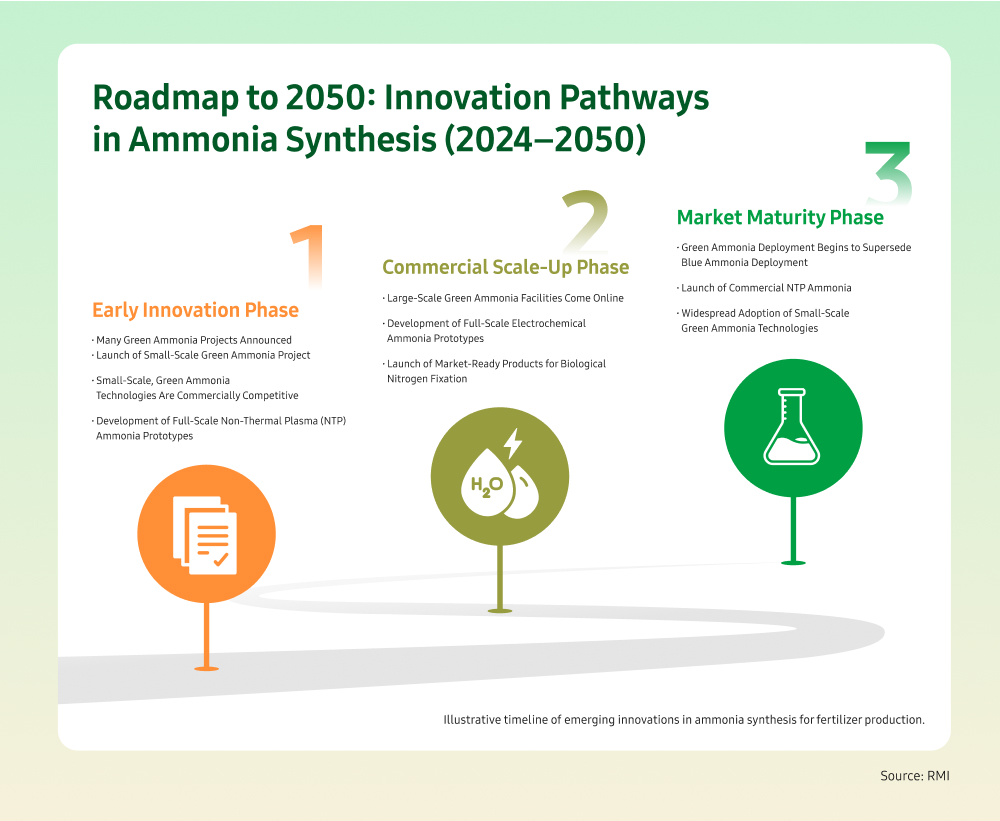

As the fertilizer industry continues to develop, various technological innovations are being explored to improve overall efficiency and reliability. Among these efforts, new approaches to ammonia production are drawing particular attention, with research focusing on ways to diversify production methods and adapt to evolving supply needs.

Ammonia synthesis, a central process in nitrogen fertilizer production, is currently seeing a wide range of innovations, including:

- Blue Ammonia, which incorporates carbon capture and storage (CCS) into conventional production methods;

- Green Ammonia, which uses renewable electricity for hydrogen generation through electrolysis;

- Emerging Pathways such as biomass gasification, electrochemical synthesis, and plasma-based systems, which are being considered for their potential in small-scale or distributed production settings.

These various approaches are at different stages of development and reflect a broader trend toward enhancing adaptability and technological diversity within the fertilizer sector.

Adapting to Evolving Market Dynamics

Fertilizer trade is shaped by a range of factors, including supply conditions, regional policies, and customer preferences.

Since the 1970s, commencing with fertilizer export operations, Samsung C&T Trading & Investment Group has continued to grow its presence on the global stage. Leveraging its experienced workforce and extensive international network, the Group is expanding its reach to various regions. By utilizing its global sourcing capabilities, Samsung C&T delivers optimized portfolios tailored to each customer’s needs across timing, geography, and product categories.