– Consolidated revenue of KRW 7.781 tn with operating profit of KRW 274 bn

– Met market expectations by maintaining quarterly OP in excess of KRW 200 bn, backed by stable performance from E&C, T&I, and Resort groups (*Q3 OP market expectations for C&T: KRW 260bn)

– Company to continue to seek stable profit growth on strategy of sound management and differentiated competitiveness

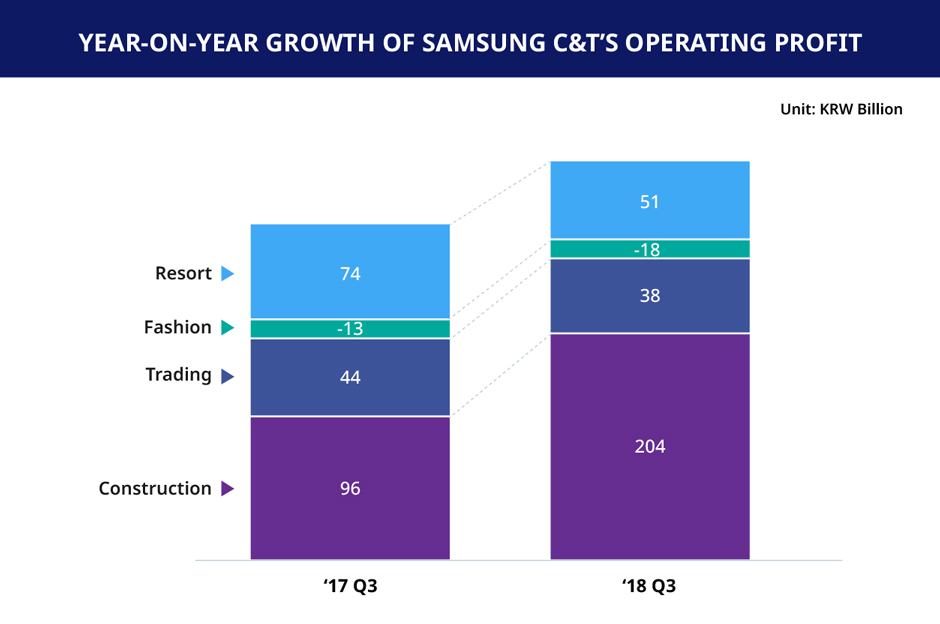

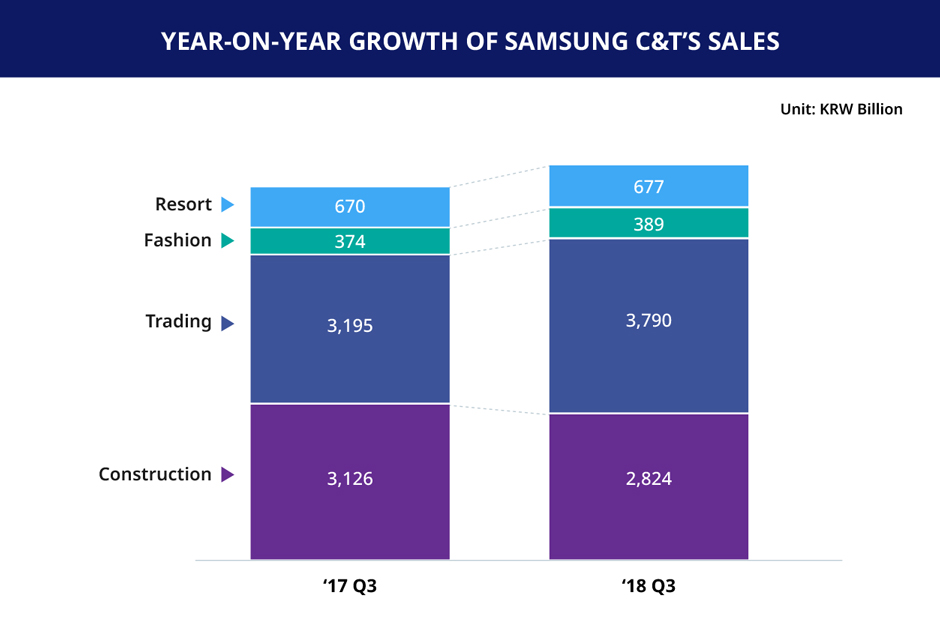

Samsung C&T on October 24 posted KRW 7.781 tn in consolidated revenue and KRW 274 bn in operating profit. This is a 4%, or KRW 288 bn, year-over-year increase in revenue from KRW 7.493 tn in Q3 2017 and a 30%, or KRW 64 bn, increase in operating profit from KRW 210 bn in the same period last year.

The growth in revenue was led by the Trading & Investment Group, which saw an increase in trade volume. Operating profit marked a year-on-year increase thanks to improvements in profitability of projects by the Engineering & Construction Group.

Engineering & Construction Group

The E&C Group posted KRW 2.824 tn in revenue, down 9.7%, or KRW 302 bn, from KRW 3.126 tn in Q3 2017. Operating profit was KRW 204 bn, up 113%, or KRW 108 bn, from KRW 96 bn in Q3 2017.

While completion of large-scale projects resulted in slight dip in the Group’s revenue compared to Q3 2017, commencement of high-profit projects in both Korea and abroad led to a significant growth in operating profit.

Trading & Investment Group

The T&I Group posted KRW 3.79 tn in revenue and KRW 38 bn in operating profit. Revenue rose by 19%, or KRW 595 bn, from KRW 3.195 tn in Q3 2017, whereas operating profit fell by 14%, or KRW 6 bn, from KRW 44 bn in Q3 2017.

The revenue growth was led by an increase in global trade volume, while a slight fall in operating profit stemmed from reduced profitability in areas such as the Group’s U.S. textiles infrastructure business.

Fashion Group

The Fashion Group posted KRW 389 bn in revenue, which is a 4%, or KRW 15 bn, increase from KRW 374 bn in Q3 2017. Operating profit was negative KRW 18 bn, which is down by KRW 5 bn from negative KRW 13 bn in Q3 2017.

The Group recorded growth compared to Q3 2017 in revenue on the back of strong sales performance from its major clothing brands. However, marketing expenses related to the launch of a new sportswear brand resulted in the operating loss increase.

Resort Group

The Resort Group posted KRW 677 bn in revenue, which is a 1%, or KRW 7 bn, increase from KRW 670 bn in Q3 2017. Operating profit was KRW 51 bn, down by 31%, or KRW 23 bn, from KRW 74 bn in Q3 2017.

Revenue increased thanks to strong performance from the overseas F&B (food & beverage) and food ingredient businesses, while operating profit fell due to decreased profits/increased costs in the landscaping business.