- Battery minerals are becoming essential to the rapid expansion of battery energy storage systems (BESS) worldwide

- As renewable energy sources grow in capacity, so does the need to store that electricity efficiently and reliably

- This article explores how grid-scale energy storage is reshaping mineral demand, how lithium has become a critical input, why materials like nickel and cobalt are in decline, and what future alternatives like sodium-ion could mean for the battery supply chain

Following the first article in the Global Commodities Outlook series, which focused on copper, this second installment explores battery minerals used in grid-scale battery energy storage systems (BESS). These systems are playing an increasingly strategic role in supporting clean energy transitions, electricity security, and the stability of power grids worldwide.

Battery storage is projected to expand rapidly this decade, with global capacity expected to reach 1,200 GW by 2030, nearly a 14-fold increase from current levels. As solar and wind deployment accelerates, BESS installations are becoming vital for balancing power systems and unlocking the full potential of renewable energy. This shift is now reshaping the structure of battery mineral demand from a mobility-focused supply chain to one centered on long-duration, infrastructure-grade applications.

The Rise of Storage: How the Grid Is Reshaping Mineral Demand

Grid infrastructure has become a major force in determining which battery materials matter most. While EVs drove early demand for energy-dense batteries using nickel and cobalt, grid-scale storage operates under different priorities—favoring cost-efficiency, thermal stability, long life cycles, and scalable deployment.

This distinction has led to the rise of lithium iron phosphate (LFP) batteries in BESS applications. LFP batteries do not use nickel or cobalt, which makes them cheaper to produce and easier to scale. As national grids increasingly adopt BESS to support intermittent renewable generation, the minerals required to support these systems are changing rapidly, triggering structural shifts across global raw material markets.

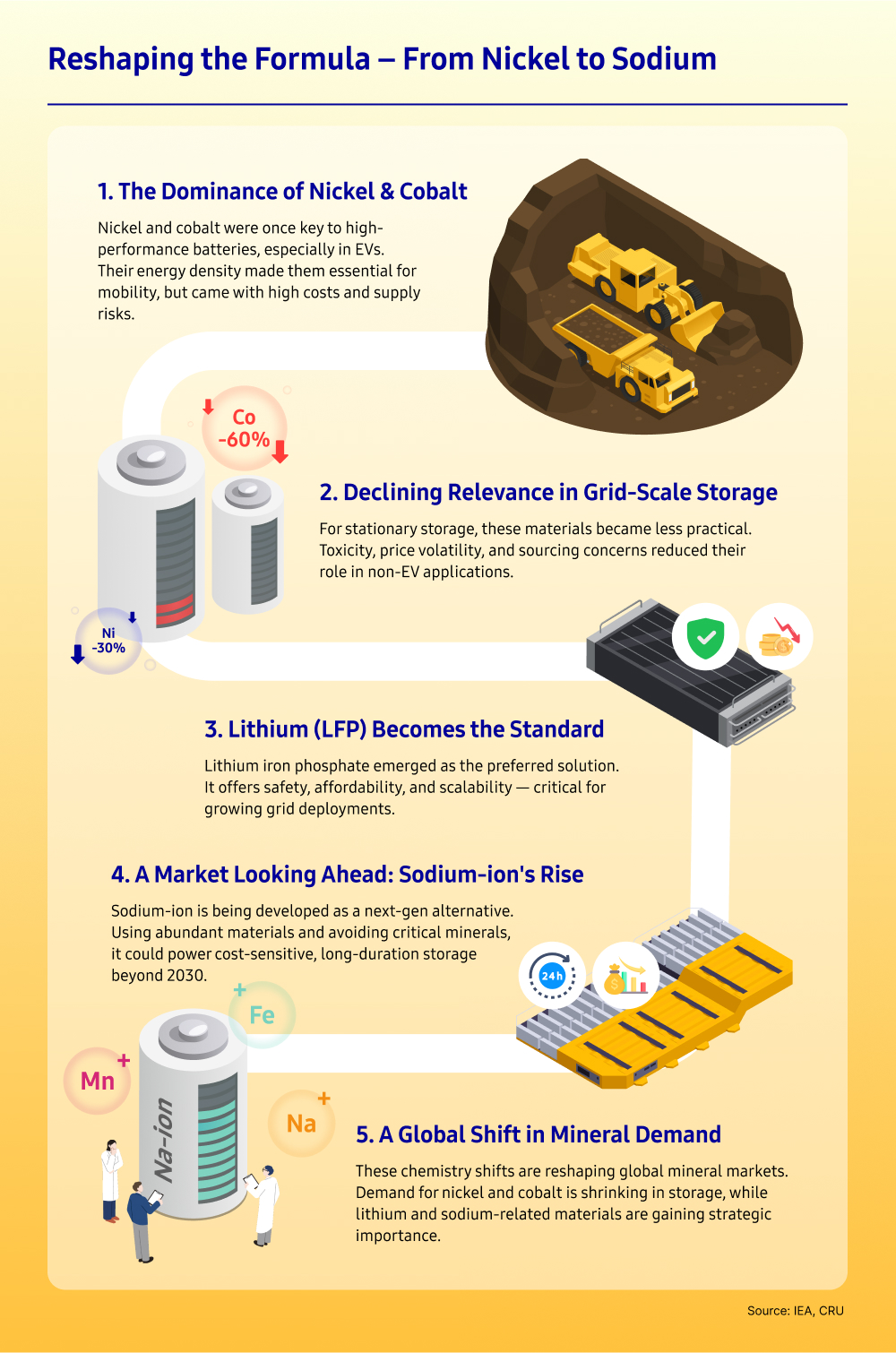

Reshaping the Formula: The Shift to Lithium and Beyond

As BESS expand across global power grids, the chemistry behind these systems is undergoing a notable transformation. While nickel and cobalt once dominated high-performance battery designs, the rise of LFP batteries and growing interest in sodium-ion alternatives is reshaping the mineral formula powering grid storage.

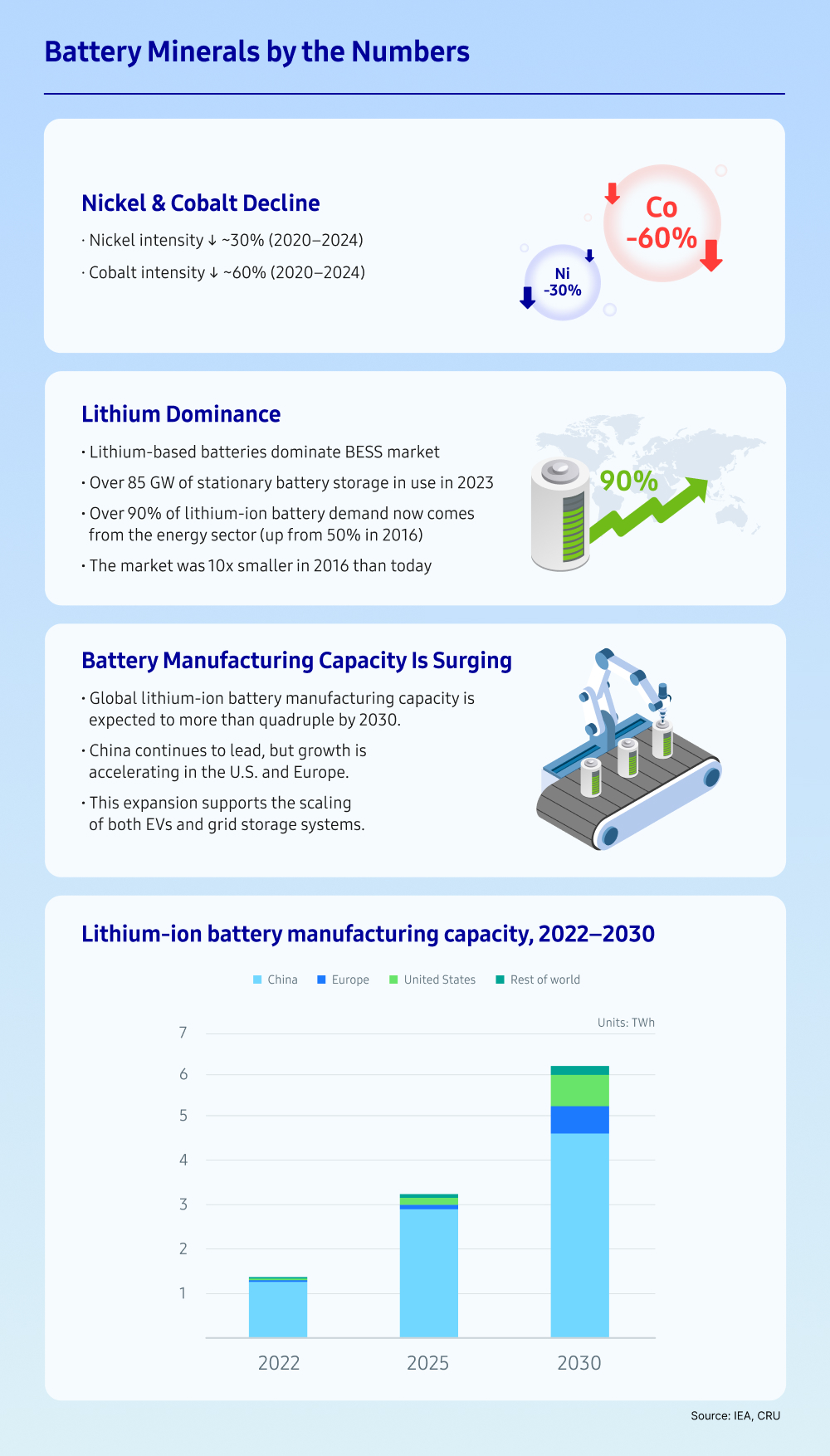

What the Numbers Reveal

Recent data reflects key changes in battery chemistry trends. Between 2020 and 2024, nickel intensity in battery systems is projected to decline by around 30 percent, while cobalt intensity is expected to fall by over 60 percent. At the same time, lithium-based batteries have come to dominate stationary storage, with more than 85 GW deployed globally in 2023. Lithium-ion battery demand from the energy sector now exceeds 90 percent, up from 50 percent in 2016. Looking ahead, global lithium-ion battery manufacturing capacity is forecast to more than quadruple by 2030, with China continuing to lead and growth accelerating in the United States and Europe.

Samsung C&T and the Battery Mineral Supply Chain

Samsung C&T Trading & Investment (T&I) Group seeks to play an important role in supporting global energy storage growth through the sourcing and supply of essential battery minerals. The company monitors evolving battery trends and strategically aligns its mineral trading operations with market needs.

As part of these efforts, the Group is actively pursuing opportunities in markets such as the United States, Canada, and Australia, regions seeing rapid growth in solar and energy storage deployment. In February 2025, the Group established a joint venture with LS ELECTRIC in the United States with the aim of developing BESS. As the first collaboration, the two companies selected a 500 MW BESS project, which is under the development by Samsung C&T in Texas. By aligning its trading portfolio with new technology trends and infrastructure-driven mineral demand, the Group is strengthening its contribution to the transformation of energy systems through responsible and timely material sourcing.