The fertilizer industry is set for steady growth over the next decade, driven by global food demand. Samsung C&T Trading and Investment Group is a key player globally sourcing and trading fertilizers, evolving to meet the demand for future trends in agriculture and clean energy.

As our global population continues to grow, the demand for food is placing pressure on farmers, food supply chains, and the health of our planet. The plants that give us food need nutrients to grow efficiently. Plants absorb nutrients from soil through their roots, a process enhanced with chemical fertilizers. While organic fertilizers have been used for centuries to help crops grow more efficiently, the widespread use of chemical fertilizers only began in the last century.

This article will outline projections for the next decade of the fertilizer market and regional trends affecting fertilizer demand.

Market Outlook for the Fertilizer Industry

Changing economic, environmental, and political factors highlight the need for food security worldwide, leading to steady growth in the fertilizer industry over the next decade. In 2023, the fertilizer market was valued at $202 billion USD and is projected to be worth $257 billion USD in 2032, with a compound annual growth rate (CAGR) of 2.7% between 2024 and 2032.

The nitrogenous fertilizer market was valued at $63.83 billion USD in 2023 and is expected to grow at a CAGR of 5.73% to reach $105.39 billion USD in 2032. The phosphate fertilizer market was valued at $65.8 billion USD in 2023 and is expected to grow to $104.02 billion USD by 2032 with a CAGR of 5.9% during the projected period.

Regional Trends in the Fertilizer Industry

In 2023, the Asia Pacific region dominated the global fertilizer market. The Asia Pacific region is home to the world’s most populous countries, including China, India, and Indonesia, and has an increased demand for food within a diverse agricultural landscape. The Asia Pacific region accumulated an estimated $101 billion USD of revenue from the fertilizer industry in 2023, roughly half of the total global value.

Strong demand growth is projected for Sub-Saharan Africa, home to 19% of the world’s agricultural land and 14% of the global population, with crop yield growth to double from 8% to 16% over the next decade. This growth will be driven by increased access to fertilizers and crop variations.

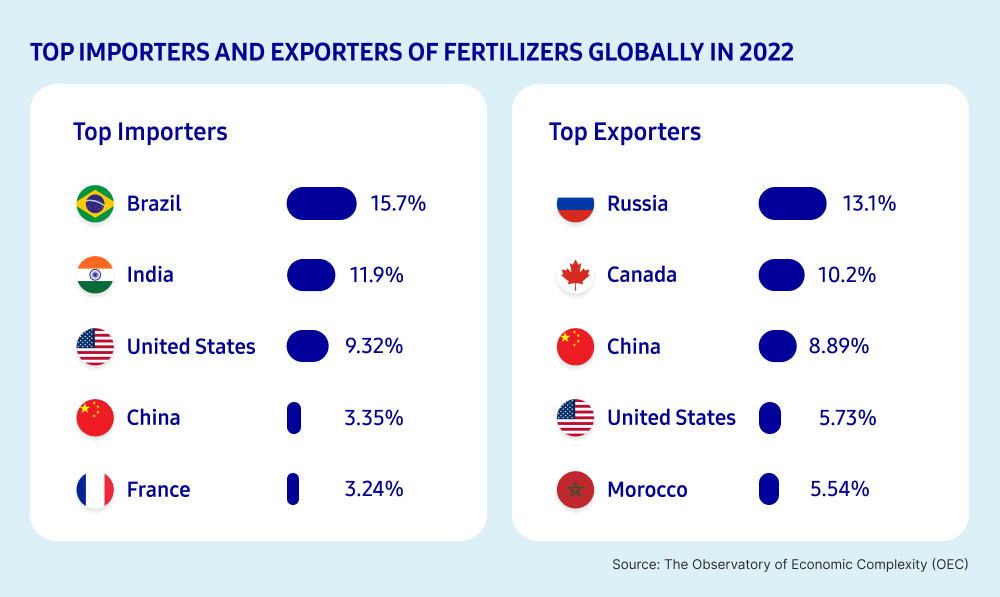

In North America, more investments are being made to increase the efficiency of fertilizers, leading to a slowdown of fertilizer exports over the next decade. In South America in 2022, Brazil imported 15.7% of the world’s fertilizer and is one of the world’s largest food-producing countries after China, India, and the United States. Strong growth is predicted for the fertilizer market in Brazil, which has strong government incentives and a growing agricultural industry.

Samsung C&T Aims to be a Top Global Fertilizer Trader

Samsung C&T Trading and Investment (T&I) Group has been exporting fertilizer chemicals since the 1970s and is a leading global trade company. The group specializes in sourcing and selling nitrogen, phosphate, compound, and potassium-based fertilizers, primarily trading in Southeast Asia, China, Oceania, the Americas, Europe, the Middle East, and Africa.

The group has leading sourcing capabilities and provides customers with exceptional portfolios that are uniquely timed based on region and product categories. As the world transitions to cleaner energy solutions, the T&I Group is diversifying its business into areas such as ammonia, which serves as a raw material for fertilizers and is a key component for clean energy.