- Global supply chains now operate in a more complex environment, with risks increasing across transport, storage, and inland logistics

- As cargo moves through multiple handling points and high-volume trade corridors, companies face greater exposure to operational failures, fire hazards, and weather-related disruptions

- Logistics insurance plays an essential role in stabilizing cargo flows and protecting goods, inventory, and third-party liabilities throughout the supply chain

Global logistics networks continue to expand, supported by larger vessels, higher cargo density, and increasingly interconnected transport routes. These developments have introduced new layers of operational complexity.

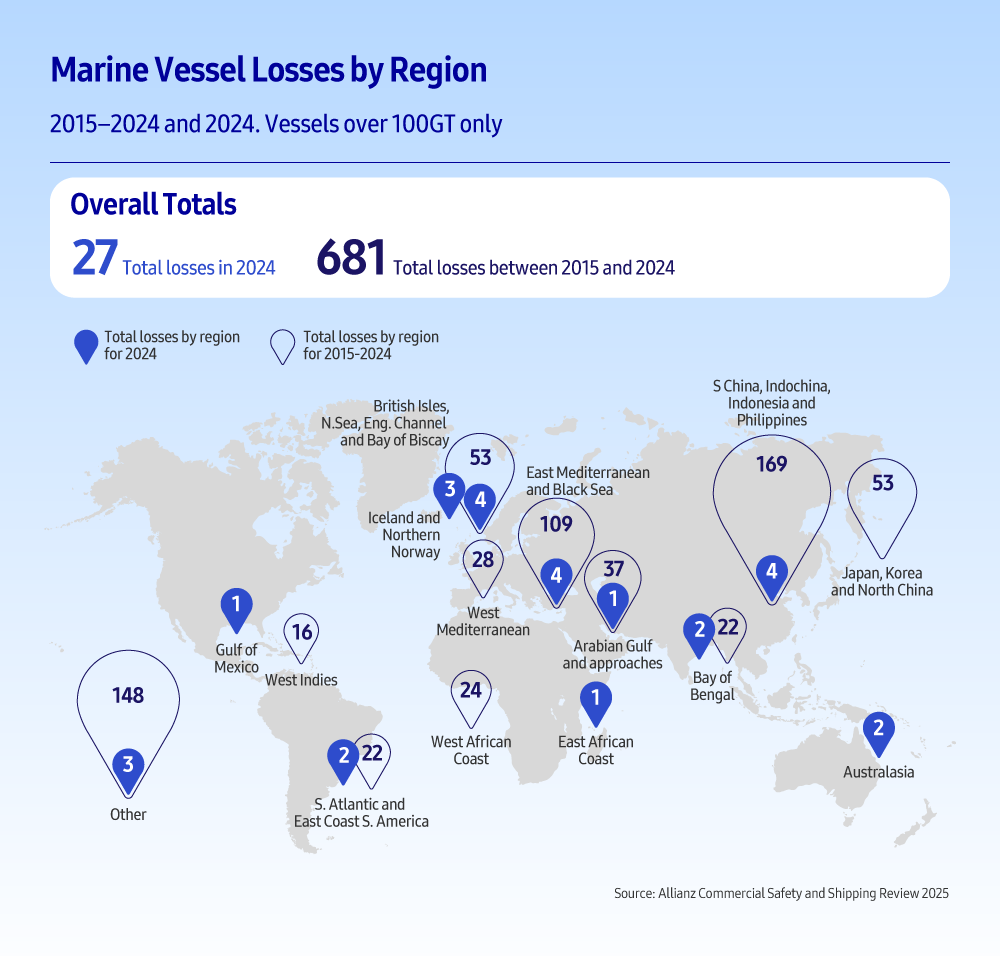

Recent operational data shows that operational disruptions remain widespread across global transport systems, with machinery failures representing one of the most common incident categories and fire-related events continuing to affect a wide range of logistics facilities and equipment.

Weather-related challenges are also becoming more frequent, affecting not only ocean routes but also port availability, inland terminals, and overland transport schedules. High-volume distribution hubs are experiencing greater strain as container yards, truck gates, and rail interchanges manage increasing cargo density. Routine processes such as loading and unloading, equipment transfers, and short-term storage, now involve more steps and tighter coordination across multiple operators.

These growing complexities increase exposure throughout each stage of cargo movement. Each time goods pass through high-activity locations such as ports, terminals, and warehouses, the likelihood of an incident rises. In this environment, logistics insurance provides essential protection across the full length of the supply chain.

What Is Logistics Insurance and Why Is It Essential?

Logistics insurance provides financial protection when unexpected incidents occur during transportation, handling, or storage. As cargo travels through increasingly complex multimodal networks, it may encounter a wide range of risks—including collision, vehicle overturning, impact damage during loading or unloading, equipment malfunction, fire, theft, natural disasters, or losses caused by malicious intent. By covering these disruptions, insurance helps companies maintain continuity in environments where delays or damage can generate significant operational and financial costs.

Clear boundaries also shape how insurance supports supply chain management. While policies protect against external, uncontrollable events, they generally exclude losses related to war, shipment delays, and market-driven price changes. This clarity allows companies to manage risk proactively and coordinate responsibilities across carriers, warehouses, and logistics partners.

For customers and partners, comprehensive coverage creates a more transparent and reliable logistics environment. It supports smoother incident handling, reduces the risk of cost disputes, and aligns cargo movement with international compliance requirements. With clear risk-management frameworks in place, companies can maintain confidence even when shipments pass through multiple jurisdictions or high-volume trade corridors.

On a broader level, logistics insurance reinforces supply chain resilience. When accidents, delays, or storage issues are covered rather than passed downstream, businesses can continue operating with minimal disruption. This is increasingly important as persistent risks such as machinery failures, handling incidents, and weather-driven events, remain a regular part of global logistics. By protecting goods, stored inventory, and third-party responsibilities, logistics insurance acts as a stabilizing foundation that supports uninterrupted and efficient global trade.

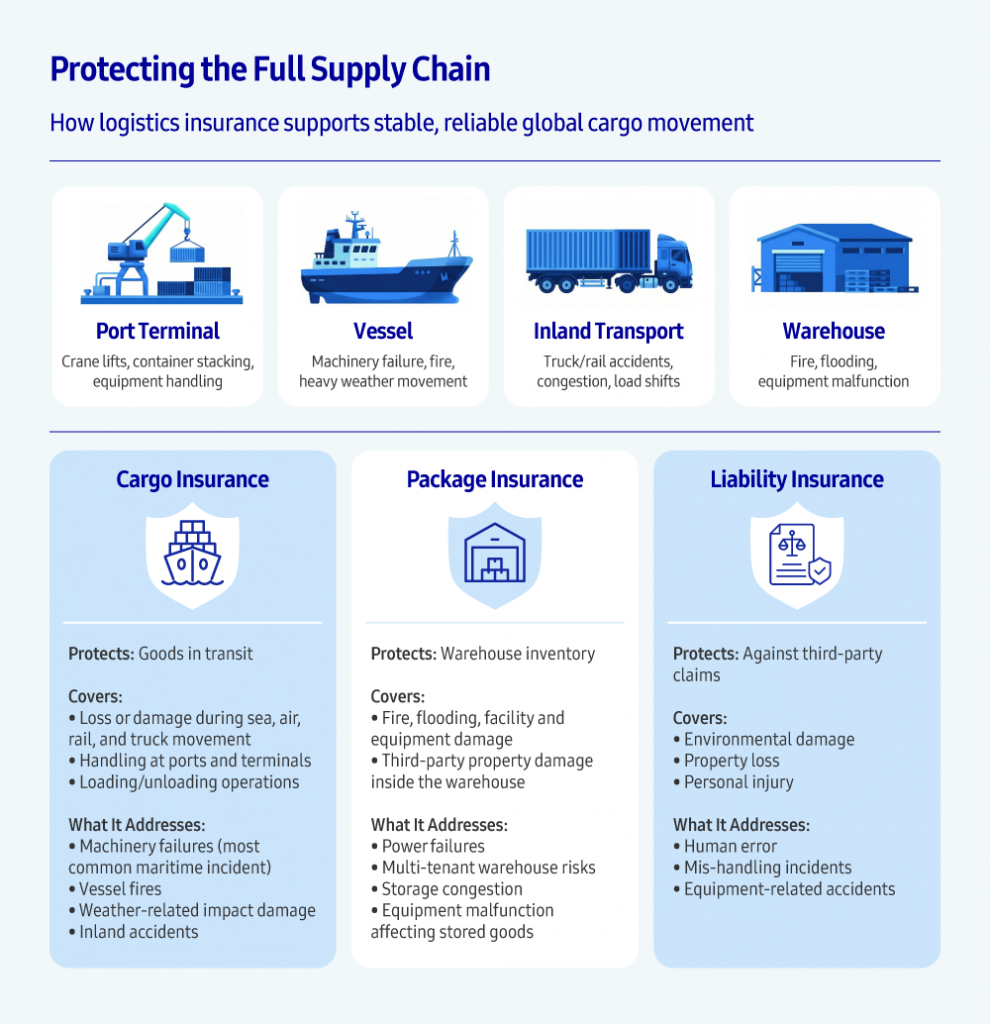

Protecting the Full Supply Chain

Modern supply chains involve multiple handovers, storage points, and transport modes, which means cargo is exposed to different types of risk at each stage of its journey. A single insurance product cannot cover every situation. Instead, companies rely on a coordinated approach that protects goods in transit, inventory in storage, and responsibilities that may arise from third-party claims. Together, these insurance types form a comprehensive framework that supports stable, predictable logistics operations across global routes.

Cargo Insurance: Protecting Goods in Transit

Cargo insurance covers physical loss or damage when goods move by sea, air, rail, or truck. It protects shipments during vessel loading, container transfers, port handling, and inland transport. Standard practice insures goods at Invoice Value + 10%, and modern all-risk clauses provide broad protection across diverse transit environments. Transit-related incidents remain common, with machinery failures, weather conditions, and high-volume terminal operations contributing to physical damage during movement. Cargo insurance ensures that these risks do not disrupt trading activities and supports reliable deliveries across international markets.

Package Insurance: Protecting Warehouse Inventory

Warehouse storage introduces its own set of risks, as goods wait for export, inland transport, or delivery to final destinations. Package insurance protects inventory in warehouses from incidents such as fire, flooding, equipment malfunction, or facility damage. It also covers cases where stored goods cause damage to third-party property. Accurate inventory values and updated warehouse information are essential for maintaining proper coverage. This insurance helps safeguard materials and products during storage transitions and supports continuous cargo movement across global supply chains.

Liability Insurance: Protecting Against Third-Party Claims

Liability insurance protects companies from third-party claims related to cargo handling, vessel chartering, or inland transport. These claims may involve environmental damage, property loss, or personal injury. Because liability exposure can occur at sea, in port terminals, or during domestic transport, this coverage ensures companies can respond effectively when incidents arise. It supports business continuity by absorbing legal and financial responsibilities, allowing logistics operations to proceed without significant disruption.

Strengthening Stability Across Global Supply Chains

As global logistics networks become more interconnected, managing risk across every stage of cargo movement is increasingly essential. For global trading companies like Samsung C&T T&I, which handle diverse commodities, industrial materials, and project-linked shipments across multimodal routes, having solid and reliable insurance coverage is essential. Samsung C&T recognizes that risks can occur not only during vessel transport but also in accident-prone locations such as ports and warehouses, where loading, storage, and equipment-related incidents occur. By applying cargo, package, and liability insurance strategically across these points, the Group ensures its shipments remain protected from unexpected events that could affect delivery schedules, customer commitments, or partner coordination.

Strengthening this coverage is particularly important as trading environments face rising volatility, whether from weather disruptions, handling incidents, facility issues, or other operational impacts. With structured insurance frameworks supporting its global activities, Samsung C&T T&I can continue to uphold reliable supply chain performance while navigating complex international trading conditions. In this way, logistics insurance functions as a foundational tool that reinforces the company’s ability to move goods efficiently, respond to change confidently, and support long-term trading partnerships across global markets.