At a glance

- Global EV sales are set to jump 35% this year, meaning 14 million more EVs on the road

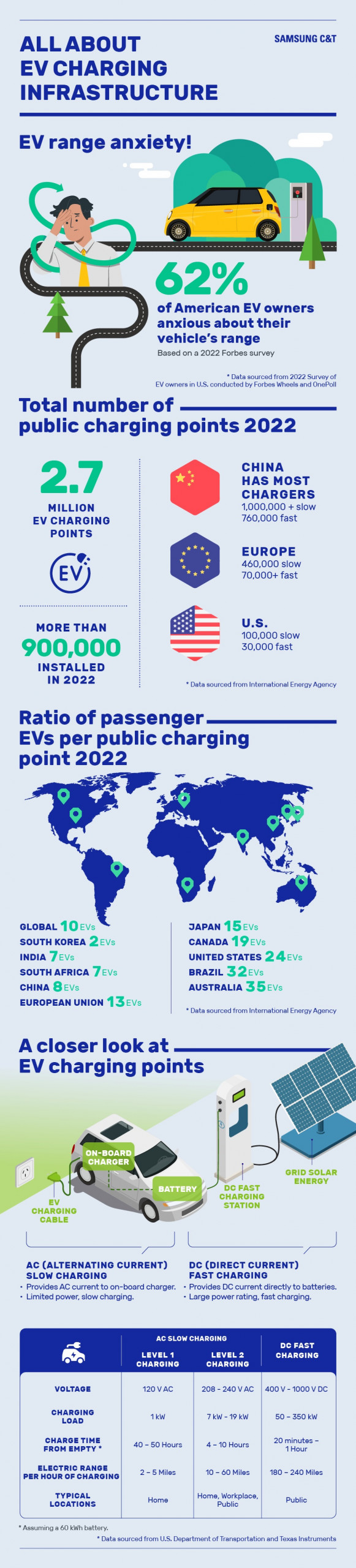

- There are 2.7 million public charging points for EVs globally, though availability varies significantly

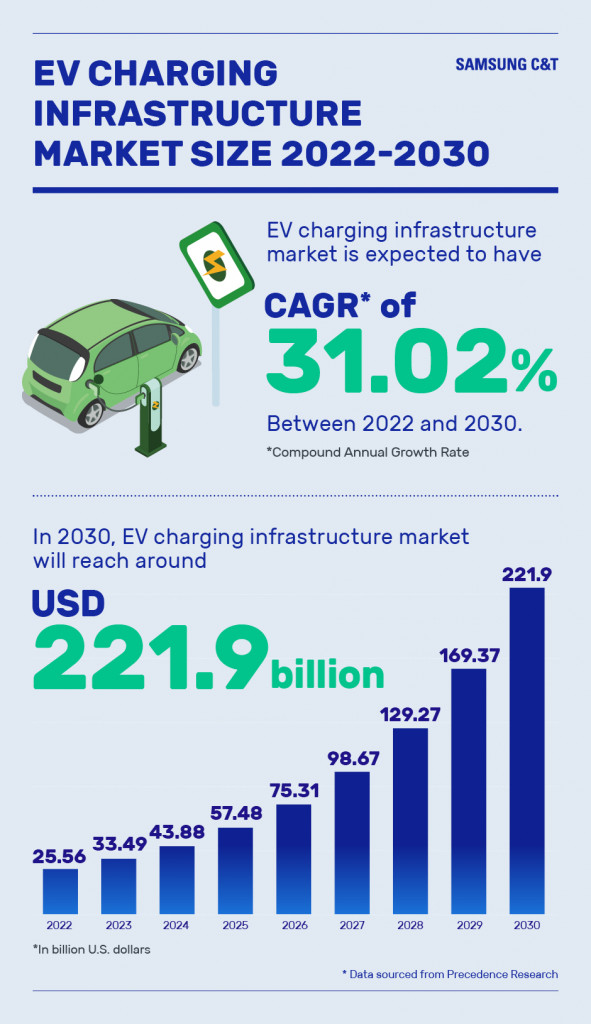

- The EV charging infrastructure market is expected to soar at a CAGR of 31.02% between 2023 and 2030

Whenever we check in on electric vehicles (EVs), demand always seems to be racing ahead. Global EV sales are expected to jump 35% this year after a record-breaking 2022 – and according to the International Energy Agency (IEA), that will spare the need for five million barrels of oil on a daily basis by 2030.

But it is clearly very important to be using clean sources of energy to keep EVs charged, while also developing the required infrastructure to support the transition to EVs. Continuing our “getting to know” series, let’s look more closely at the state of EV charging infrastructure.

How much do you know about EV charging?

The IEA’s Global EV Outlook 2023 notes that more public charging points are needed to enable the expansion of EVs on the road. The total number of public charging points available worldwide stood at just 2.7 million by the end of last year, while over 10 million EVs were added to global roads in 2022 alone – and 14 million more are set to be sold this year.

Some countries appear to have a more urgent need for wider EV charging capabilities than others. As demonstrated by our infographic below, EV drivers in South Korea enjoy a relative abundance of public charging points – with one for every two EVs in the country as of last year based on the IEA’s data. By comparison, the United States had one public charging point for every 24 EVs in 2022. Perhaps it is unsurprising that more than six in ten American EV owners expressed “range anxiety” about how far they could drive before they would have to charge up again according to 2022 survey results published by Forbes.

For EV drivers in locations where public chargers are lacking, they may use slower alternating current (AC) chargers at home or work that will get the job done over a few hours. The more practical solution to resolve range anxiety, however, would be the kind of public stations equipped with direct current (DC) chargers where an EV driver can get their vehicle charged up in as little as 20 minutes.

The EV charging infrastructure market

There is momentum to expand the quality and quantity of EV charging infrastructure, with government regulations favoring clean energy solutions such as EVs. There are also continual EV charging innovations such as owners being able to take advantage of bi-directional charging, which uses the vehicle’s battery to send power to other devices or even back to the grid.

With interest in EVs growing all the time, as we have seen, the global EV charging infrastructure market is set to be worth US$221.9 billion by 2030, up from US$25.56 billion in 2022, growing at a CAGR of 31.02% between 2023 and 2030. That includes both residential and commercial EV charging applications. Heavy vehicles, including trucks, are also expected to undergo wider electrification, driving the development of so-called megachargers with a power output of 1 MW or more. And another area of advancement already underway will see the expansion of smarter EV chargers, offering more automated, wireless, and convenient options to EV owners.

Where does Samsung C&T fit in?

Samsung C&T Trading & Investment Group has been striving for several years to strengthen its eco-friendly business portfolio, including renewable energy, hydrogen, and solar power development.

The company has also been supporting EV battery recycling by supplying key materials such as nickel and cobalt that have been extracted from old batteries. As the EV charging market is expected to grow rapidly, Samsung C&T is continuing its efforts to secure business opportunities in related areas ranging from supplying EV chargers to the establishment of EV charging station infrastructure. While some of these projects are in the preparation stage for now, we will have more to share in our next update – when there will hopefully be just as much buzz around charging infrastructure as there is about EV sales.