Shipping products by sea is one of the most practical logistics solutions, as sea freight can include all kinds of cargo. In addition, when carrying cargo of equal weight and transporting the same distance by sea and air, the carbon dioxide emitted by sea transport was about 44 times less than air transport. Because of this, sea freight is considered the most carbon-efficient way to transport goods and efforts are underway to minimize the environmental impact of shipping.

Another leading advantage of ocean shipping is that it is significantly cheaper than air transport. But this benefit has been eroded this year with the cost of moving goods by sea getting a lot more expensive. To illustrate, container shipping rates from China to the United States have risen above US$20,000 per 40-foot box – a record high and 500 percent up from a year ago, according to freight-tracking firm Freightos. It is a similar story when we look at indices tracking the cost of moving containers – the Shanghai Containerized Freight Index (SCFI) exceeded 4,000 points for the first time ever in July, having stayed below 1,000 for most of the last decade.

Why are sea freight rates suddenly so much higher?

When supply is squeezed, basic economics dictates that costs will go up. To illustrate the impact of slowing down trade, we saw what happened earlier this year when the Suez Canal got blocked for almost a week, which cost an estimated US$9.6 billion of trade each day until it was cleared and played an important role in driving up freight rates this year.

Meanwhile, the COVID-19 pandemic’s footprint continues to be felt across industries worldwide, and it has also been blamed for slowing the turnaround of shipping containers and therefore driving up freight rates. And yet, the pandemic has also been responsible for creating stronger demand for imported goods and materials.

Some major ports have seen turnover held up by 7-8 extra days. In China, a logistics crisis saw 350,000 containers from around the world piled up at Yantian Port by the end of June due to COVID-19 prevention efforts. With 50 ships crowding around the port unable to unload, the berth period at Yantian Port increased from an average 0.5 days to 16 days, with the daily handling container count dropping from 36,000 to 10,000 on average!

Moreover, a logistics crisis in California driven by increased consumption saw January arrivals of container ships increase by up to four times, causing a bottleneck and reducing logistics processing capabilities. The knock-on effect was a shortage of containers for logistics in Asia and higher shipping costs.

You can also add climate change factors such as typhoons off China’s southern coast, flooding in Europe, wildfires in North America – these have all played a role in further holding up trade. We are likely to see even more strain around upcoming traditional shopping periods like Christmas and Black Friday, and there are valid concerns this could impact the price of consumer products.

A posture to cope with soaring sea freight rates

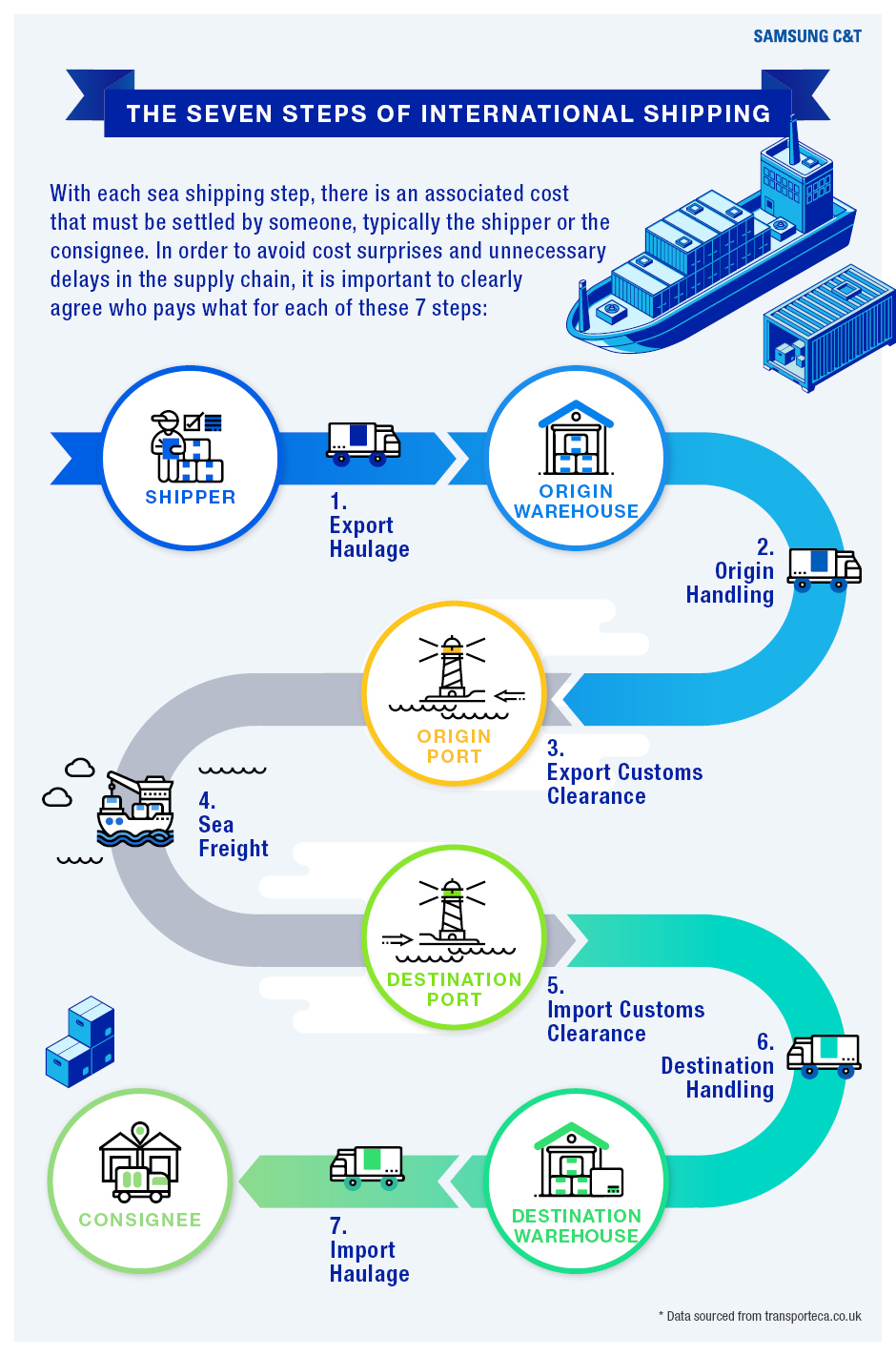

With freight rates expected to remain higher for years, what can be done? As well as helping to prevent the spread of COVID-19, it would be useful to monitor the port situation. In addition, it will be necessary to negotiate the costs incurred at the transport stage, including tariffs, customs clearance, conditions of incoterms, and other transportation costs.

In addition, using a shipping company that specializes in a particular item may be helpful, and efficient transportation routes such as land and air should be selected depending on the type of logistics or distance of transportation. Working with various global authorities to maximize the benefits of facilities like logistics centers run jointly by governments and export-related organizations could be a solution.

All these factors are naturally taken into consideration by Samsung C&T Trading & Investment Group, which focuses on securing efficient marine freight rates along with the best overall logistics solutions for its customers. Samsung C&T T&I is also making efforts to diversify its transportation form or find alternative routes to derive optimal freight costs. In order to provide the best logistics solutions to customers, Samsung C&T shares real-time logistics information with 80 bases in 40 countries around the world, also cooperates with logistics partners with whom it has built trust over a long period.