The materials we will rely on over the next three decades are the building blocks for the low-carbon technologies required to meet net-zero targets by 2050. This article provides an outlook on the demand for key materials, including lithium, copper, cobalt, and nickel.

The global energy transition is seeing countries shift to renewable energy sources, replacing technologies that rely on fossil fuels with low-carbon alternatives. There has been a large push to accelerate renewable energy supply and decarbonization due to the growing environmental impacts of climate change.

With this shift towards a net-zero emissions future comes the demand for infrastructure for renewable energy, such as solar and wind power, and the demand for electric vehicles (hereby referred to as EVs) to decarbonize the transportation industry. The raw materials we rely on to build these technologies include lithium, copper, cobalt, nickel, and rare earth elements. With growing demands for this technology comes the risk of these materials facing supply shortfalls over the coming years.

In this installment of Market Inside & Beyond, we will analyze the materials needed for the energy transition and help us reduce our dependency on fossil fuels. It will also highlight the risk of the rapidly growing demand for materials such as copper and the adverse effects material shortages could have on the progress of our 2050 net-zero targets.

The Key Materials We Will Rely on for the Global Energy Transition

We recently published an article about the impact of EVs on the global energy transition, highlighting EVs and their role in reducing greenhouse gas emissions in global transportation sectors. The rising demand for low-carbon technologies such as EVs could put a strain on the supply of materials such as lithium, copper, and cobalt, which are key materials used to make the batteries that power them. Technologies like EV batteries are more energy-intensive to manufacture because the materials they rely on are often in short supply.

According to a 2023 report by McKinsey and Company, by 2030, Battery Electric Vehicles (BEVs) and their chargers will consume more than 50 per cent of rare-earth material supplies, 55% of cobalt supplies, and 36% of nickel supplies. Looking to the future, is it possible to meet the demands of our net-zero targets? What are the threats of limited supply chains on the progress of the energy transition, and what can be done to ensure materials security for the low-carbon technologies transforming our world for the better?

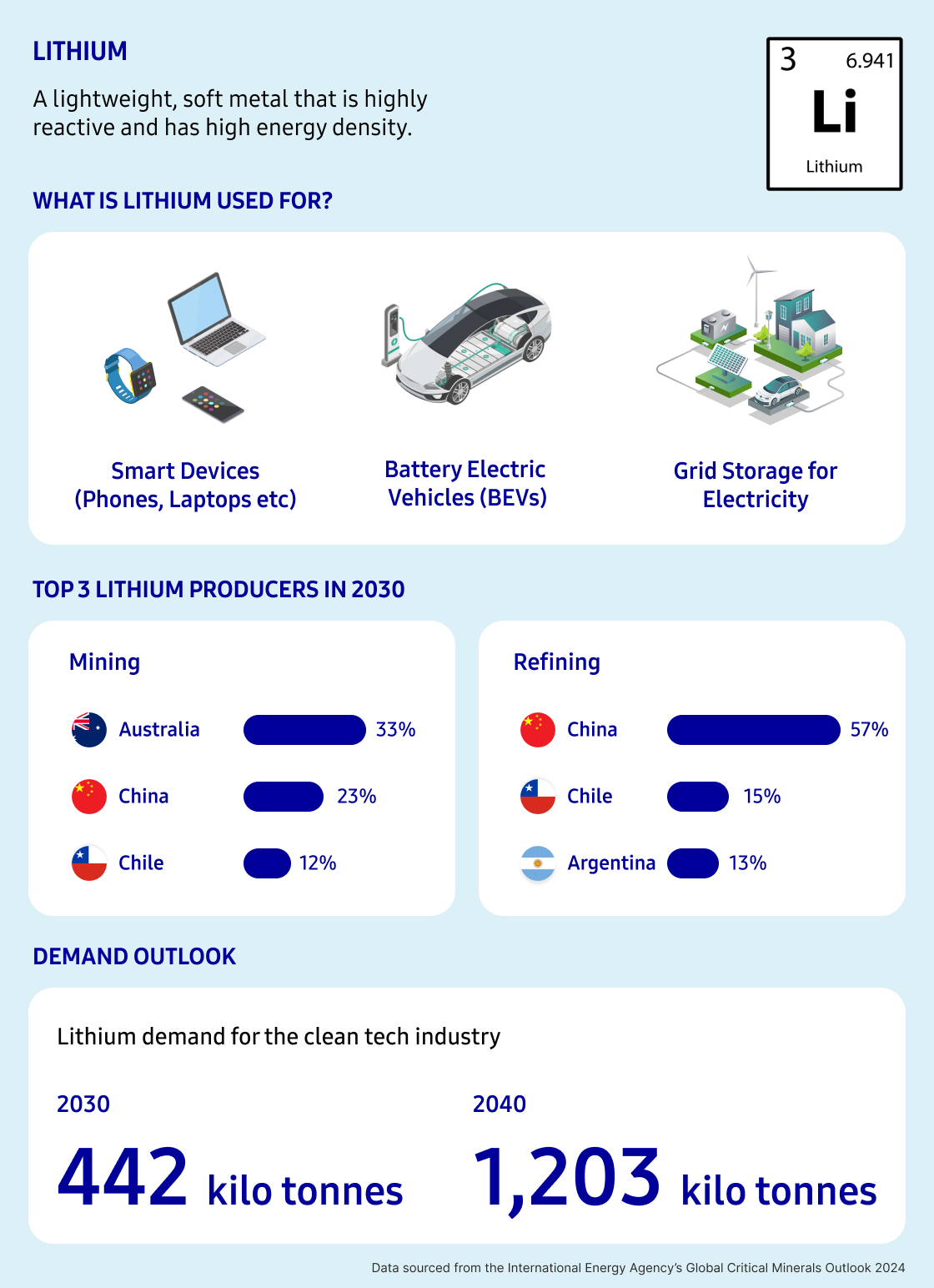

Lithium

Lithium is a lightweight, soft metal that is highly reactive. Lithium is a key component used to make rechargeable batteries for electronics, such as laptops and smartphones, electric vehicles, and grid storage to store electricity. Estimates state that there are only 101 lithium mines in the world.

Demand for Lithium

Lithium is currently facing the fastest demand growth in the clean energy transition. According to the International Energy Agency’s (IEA) 2024 Global Critical Minerals Outlook, lithium demand rose by around 30% in 2023, similar to the level of growth in 2022. By 2030, lithium used in BEV batteries is projected to account for more than 80 percent of total lithium demand, according to McKinsey and Company. Battery storage only accounts for around 5% of lithium demand, but this is expected to rise over the coming decades.

Copper

Copper is a malleable metal known for its ability to conduct electricity and heat. Copper is crucial for technologies driving the shift to cleaner energy through the global energy transition. Copper is used to make EV batteries, EV motors, solar photovoltaic (PV) power, wind power, and electricity networks.

Copper’s electronic conductivity, longevity, ductility, and corrosion resistance make it the perfect material for a wide range of electronic applications. It can be processed into electrolytic copper, a highly conductive material used to create electrical wires, and copper foil, an ultra-thin material used in batteries and electronics.

Most of the world’s copper comes from Chile, which holds 23% of global copper reserves, the Democratic Republic of Congo (DRC), Peru, and China. According to Forbes, China imported 27.54 million tons of copper in 2023, the most in any year on record.

Demand for Copper

Copper’s key role in the global energy transition includes connecting renewable energy sources to power grids. There are projections that the future copper supply is at risk of being unable to meet the needs of the rapid shift to cleaner energy sources. According to a report by S&P Global, 2050 net-zero targets could be “short-circuited” if the global supply of copper cannot be increased.

According to the IEA, demand for refined copper increased by 2.7% in 2023, up from 0.9% in 2022. This was largely due to growing copper consumption in China and India. Copper is projected to double in demand by 2035 according to S&P Global’s report “The Future of Copper,” with demand projected to grow from 25 million metric tons (MMt) today to about 50 MMt by 2035, that will continue to grow to 53 MMt by 2050.

The growing demand for copper is mainly due to the projected growth of EVs and renewable energy infrastructure needed to meet targets for the 2050 net-zero emissions outcome. By 2050, the percentage of the total global energy demand required to produce copper could account for between 1.0 and 2.4%.

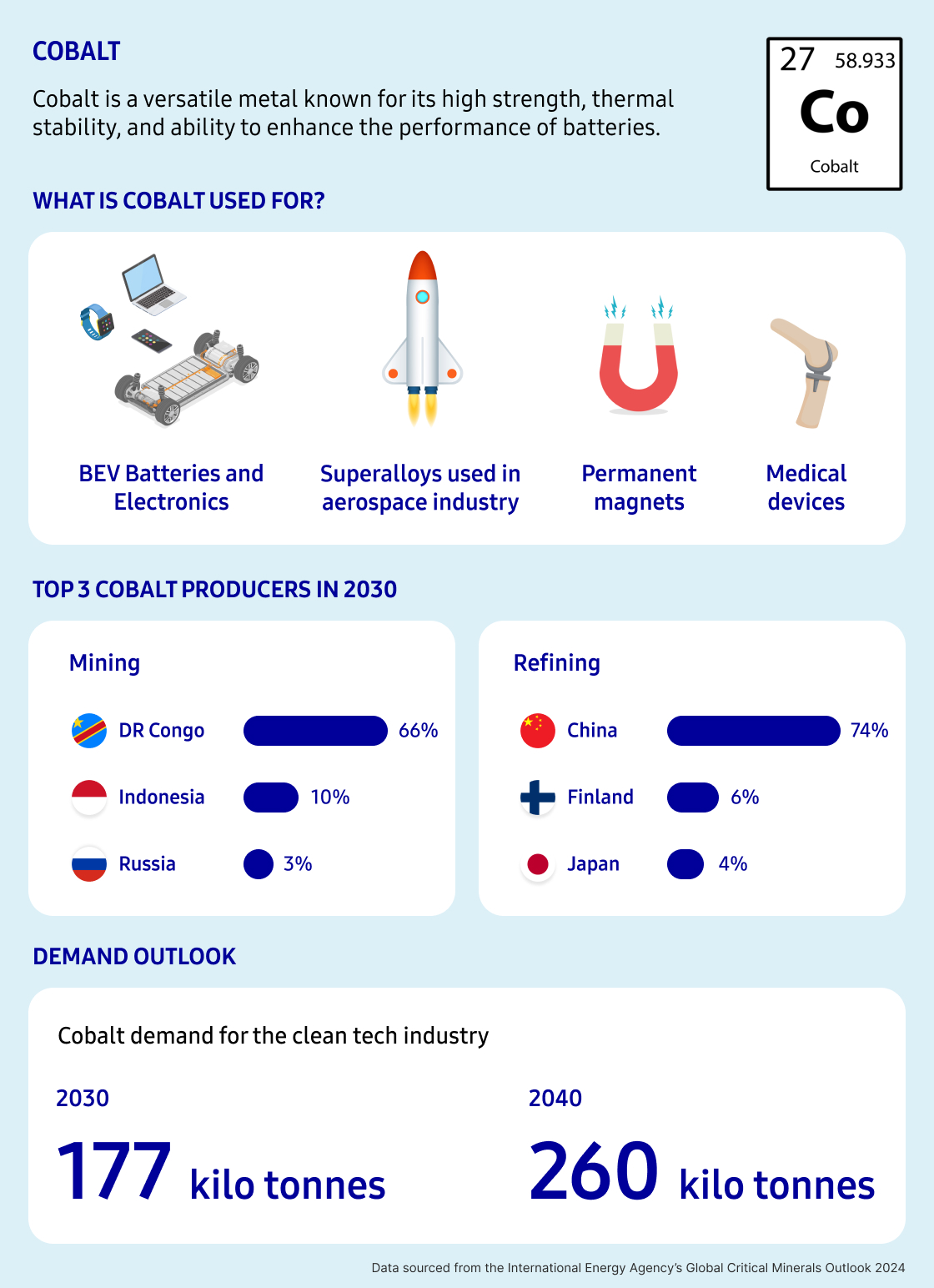

Cobalt

Cobalt is a versatile metal known for its high strength, thermal stability, and ability to enhance the performance of batteries. It is an essential material used to stabilize lithium-ion batteries, including those found in EVs, and reduces the risk of the batteries catching fire. Cobalt is also used in medical devices due to its resistance to corrosion and high strength, as well as in aerospace and military applications for its strong resistance to extreme temperatures and high pressure.

Demand for Cobalt

Cobalt is currently in oversupply but will continue to be a vital metal in the energy transition for the foreseeable future. In 2023, 30% of the total cobalt supply was used in the EV battery sector; the remaining 70% was used in the non-clean energy technology sector. Cobalt demand has increased 8-10% annually over the last two years, with the supply of mined and refined cobalt both expanding significantly.

In recent years, lithium-ion battery manufacturers have been finding alternative ways to build EV batteries without cobalt. Several factors are driving this innovation, one of which is cobalt’s scarcity and the tendency for its value to fluctuate. According to the IEA, this could lead to slower long-term growth of cobalt compared to other metals found in batteries such as lithium and nickel.

Nickel

Nickel is a durable metal valued for its corrosion resistance and strength, which is crucial for making battery alloys and stainless steel. Nickel is used in energy storage systems and renewable energy power generation, such as wind and geothermal energy. Nickel is also a crucial metal for generating green hydrogen during the electrolysis stage. Nickel will play a vital role in the energy transition as hydrogen, particularly green hydrogen as it is produced with renewable energy, becomes a more prevalent energy source.

Demand for Nickel

Global nickel demand has been falling steadily since 2020, and prices fell more than 40% in 2023. According to Bloomberg, 17% of Nickel demand in 2023 was from the battery sector. The decrease in demand for nickel is leading to lower prices, which could lead to reduced prices for EVs, helping the market grow. However, like cobalt, EV battery manufacturers are finding ways to create batteries without nickel. The demand for nickel over the next few decades will come from the clean energy sector.

The rapid demand for low-carbon technologies is putting a strain on critical resource supplies and could threaten progress to net-zero targets. Copper prices, for example, could increase up to 75% over the next 2 years. This could lead to an increase in EV prices and slow down the progress of renewable energy infrastructure.

Taking the risk of volatile supplies into consideration, it will become more important over the next few decades to increase efforts to recycle resources and work towards creating a circular economy. A circular economy is a system where materials used to make products are recycled so that they never become waste products. Keeping materials and their byproducts within a closed loop ensures that fewer resources are needed to create new products.

Recycling does not always take place at the end of a product’s life due to a lack of infrastructure, difficulty extracting certain materials, or the design of the product itself makes it difficult to disassemble to separate the materials that can be salvaged for recycling. Investments into recycling infrastructure and creating a circular economy throughout the entire lifecycle of vehicles, electronics, and other consumer goods, is a solution that could help ease pressure on supply chains.

Samsung C&T T&I Group’s Global Trading Network

Samsung C&T’s Trading and Investment (T&I) Group provides comprehensive business solutions and supply chain development for raw and refined metals. Through its global networks of supply chains, the T&I Group ensures a secure supply of raw materials to smelters in China, South Korea, and Europe through optimal combination and transportation.

The T&I Group sources copper concentrates of different grades from mines located in Mongolia, Canada, Mexico, Peru, and Chile. It maintains a stable supply of copper from major producers such as the Democratic Republic of the Congo and identifies consumers and sells copper in growing markets including South Korea, Southeast Asia, and China, which accounts for 50% of global copper consumption. In addition, the group also trades recycled battery materials such as nickel, cobalt, and lithium to reduce waste and ensure a more sustainable product lifecycle.

The T&I Group is committed to leveraging existing networks and working with new suppliers to fulfill the growing demand from battery cell and cathode material manufacturers and continues to strengthen its sustainable business portfolio by seeking new opportunities through partnerships with reliable companies overseas.