- Copper is essential to electrification, but its role extends beyond the energy transition

- From AI-driven data centers to global supply chain shifts, copper demand is reshaping industries worldwide, highlighting both opportunity and growing risks

A Global Race for Critical Minerals

Governments and industries around the world are accelerating efforts to secure stable supplies of critical minerals. These materials underpin electric vehicles, renewable energy infrastructure, digital networks, and advanced manufacturing.

While much attention focuses on battery materials like lithium, cobalt, and nickel, copper’s role is equally vital. It powers electrical grids, connects telecommunications infrastructure, and enables the transition to low-carbon energy.

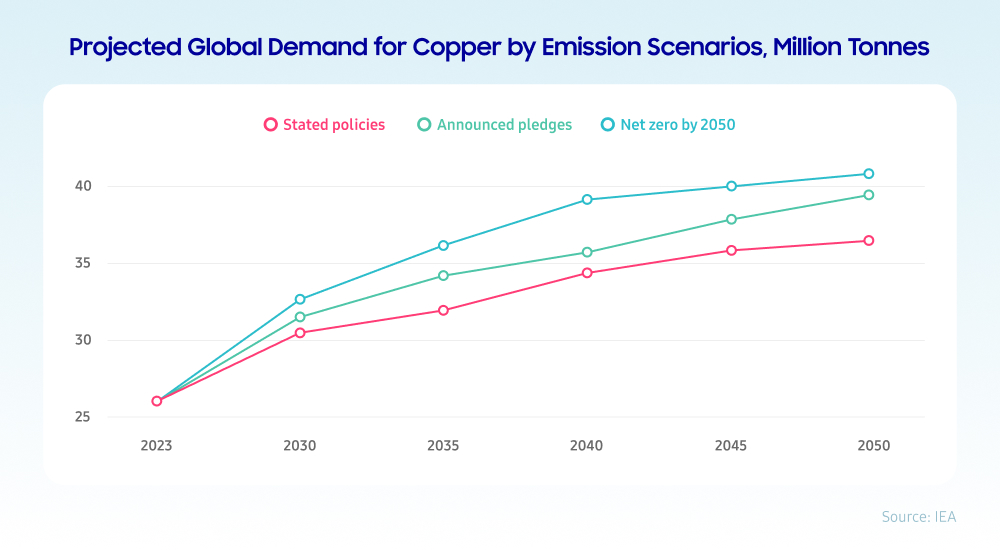

Global copper demand reached 26 million tonnes in 2023, according to the International Energy Agency (IEA). That figure is projected to exceed 35 million tonnes by 2035 if current climate policies are implemented, with nearly 40 million tonnes required under a net-zero scenario by 2050. The IEA outlines three demand scenarios—STEPS, APS, and NZE—each reflecting a different level of global climate ambition and policy implementation:

- STEPS (Stated Policies Scenario): This scenario assumes that only the climate and energy policies currently in place or officially announced by governments will be implemented. It reflects the most conservative trajectory and is often used as a baseline for comparing other scenarios.

- APS (Announced Pledges Scenario): This scenario assumes that countries fully implement all climate targets they have announced, including 2030 goals and long-term net-zero pledges. These targets are counted whether or not they are legally binding. The APS shows the emissions pathway if all commitments are delivered on time and in full.

- NZE (Net Zero Emissions Scenario): This scenario shows how the global energy sector could reach net-zero CO₂ emissions by 2050, with advanced economies achieving this sooner. It assumes rapid clean energy deployment, strong global cooperation, and progress on climate and sustainability goals including universal energy access.

While demand grows steadily, supply remains under pressure.

More Than Just a Metal

Copper‘s strategic value extends far beyond its historical uses. As demand for electrification, digital infrastructure, and energy efficiency grows, copper remains indispensable across modern industries. Its unique combination of durability, conductivity, and recyclability makes it essential for both legacy infrastructure and emerging technologies.

Applications of Copper

In electrical engineering, copper enables reliable power distribution, grid resilience, and efficient energy transmission. Its strength and flexibility through alloying support a wide range of construction applications, from structural components to building materials and advanced piping systems.

In the energy sector, copper is foundational to renewable energy infrastructure, including wind turbines, solar panels, and electric vehicles. An electric SUV contains approximately 100 kilograms of copper, with even greater volumes required for electric buses and large-scale energy storage.

Copper’s role also extends to sectors like healthcare, where its antimicrobial properties support hygiene in high-traffic environments, and to architecture, where copper alloys provide durability, aesthetics, and corrosion resistance. Across these industries, copper remains both a critical enabler of economic development and a benchmark for global supply chain resilience.

Copper’s Growing Role in AI and Data Centers

Beyond its essential role in electrification, copper demand is expanding due to the rapid growth of artificial intelligence (AI) and digital infrastructure. AI applications require vast amounts of computing power, fueling the global expansion of energy-intensive data centers.

Copper plays a vital role in these facilities due to its high electrical and thermal conductivity, durability, and affordability. It is widely used in power distribution equipment, cooling systems, and high-performance network infrastructure. AI server racks, in particular, have significantly higher power requirements than conventional servers, making them even more copper-intensive.

According to the IEA, global copper demand from data centers, including those supporting AI, is estimated to reach between 250,000 and 550,000 tonnes by 2030. This estimate is based on the STEPS scenario, which assumes countries implement only currently announced policies. Under this scenario, AI and data center-related demand would account for about 1–2 percent of global copper consumption by 2030.

While the percentage may appear small, it represents a rapidly growing segment driven by the exponential rise of AI adoption. There is also considerable uncertainty in forecasting copper use in AI infrastructure, with estimates varying by as much as ten times depending on the configuration and cooling intensity of each facility. This emerging demand adds a new layer of pressure to global copper markets.

Market Challenges: Recycling, Concentration, and Regional Shifts

Despite growing attention on circular economy solutions, recycling alone cannot close the copper supply gap. Secondary copper accounts for less than 17 percent of global supply as of 2024, a slight decline compared to 2015. Barriers to scaling recycling include rapid demand growth, trade restrictions on scrap materials, and high energy and shipping costs impacting profitability. Even under ambitious policy scenarios, recycled copper is projected to provide only around 35 percent of supply by 2050.

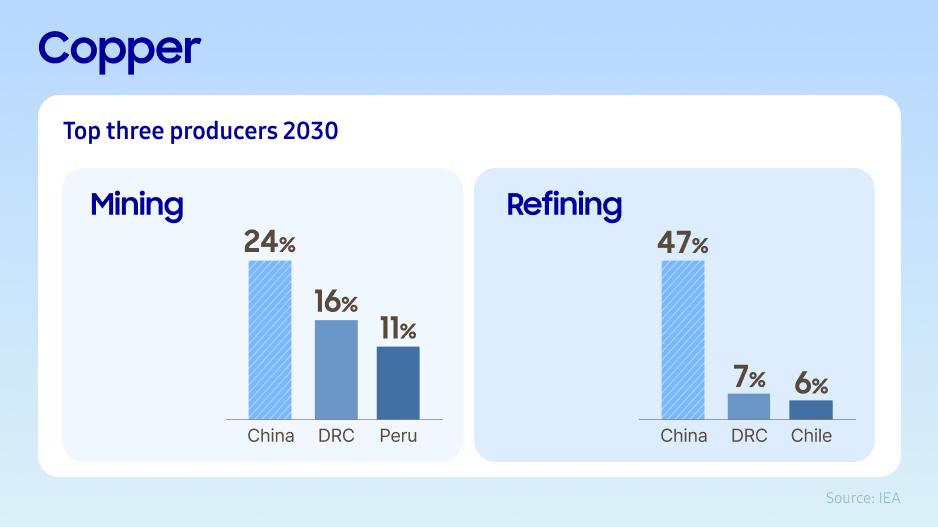

Copper mining is more geographically distributed than some other critical minerals, but refining remains highly concentrated, with China accounting for nearly half of global refined copper output. Planned mining and refining projects in countries such as the Democratic Republic of the Congo (DRC), Zambia, Panama, Peru, and the United States aim to diversify supply. However, these projects face significant challenges, including environmental concerns, regulatory hurdles, and cost competitiveness.

Structural factors also weigh on supply. Ore grades have declined by approximately 40 percent since 1991, and new copper discoveries have slowed. Developing new mining projects takes an average of 17 years, with escalating costs making it harder to bring new supply to market.

Meanwhile, regional demand is shifting. India is expected to surpass the United States as the world’s third-largest copper consumer by 2050, with Vietnam also emerging as a significant growth market. These changes are reshaping global trade flows and investment priorities across the copper value chain.

Samsung C&T’s Copper Trading Business

Against this backdrop, Samsung C&T’s Trading & Investment (T&I) Group has been engaged in copper trading since 1981, contributing to stable copper supply chains for industries worldwide.

By combining procurement, transportation, and customized sourcing, Samsung C&T T&I Group continues to support growing copper demand across sectors ranging from energy and construction to advanced manufacturing.