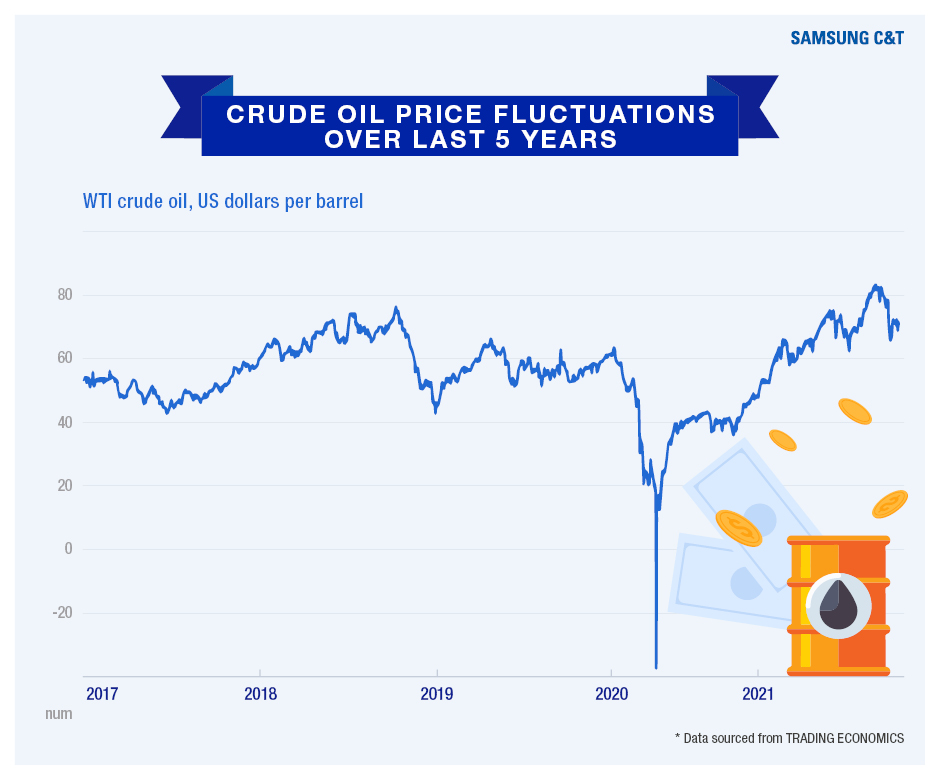

It’s been a rollercoaster ride for international crude oil prices during the COVID-19 pandemic. When you look at a graph of the last five years, you can see that they plummeted in early 2020 at the same time as the pandemic struck.

To further illustrate the point, consider that back in October the price of crude oil prices reached multi-year highs. And then by November it experienced its biggest monthly fall since that slump at the start of the pandemic.

Just to clarify, when we refer to crude oil prices, the general benchmarks are West Texas Intermediate (WTI), Brent, and Dubai. WTI crude is the basis for determining the price of all crude oil traded in the American market. Brent crude is produced in the North Sea off Britain and is widely used in Europe and Africa. And Dubai crude is the standard for the price of crude oil in the Middle East, while being mainly exported to Asia. Volatility in these benchmarks has major effects on the world, including trading companies. Let’s explore this global impact further.

A massive footprint on a global scale

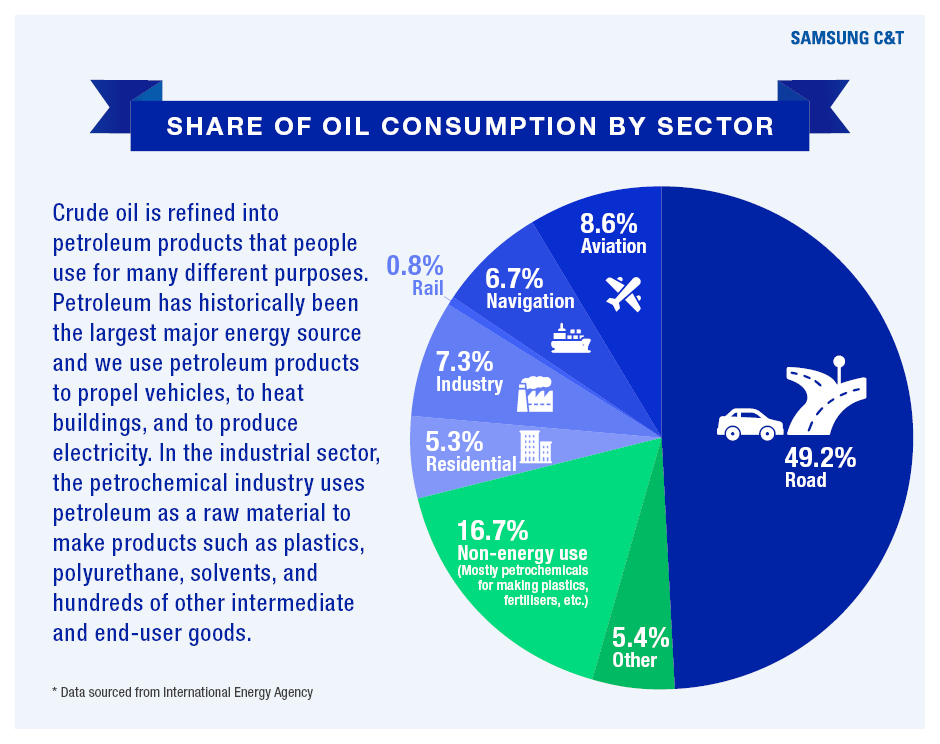

Crude oil price volatility matters because its footprint extends to so many industries. When media reports address crude oil prices, they often draw the link to the cost of refueling vehicles. This is because gasoline and diesel fuels are made from petroleum, which is another name for crude oil.

Additionally, as we previously discussed, there are a surprising number of other key materials that are also derived from crude oil.

In brief, these include plastics, fibers, and many petrochemical products used to make everything from cosmetics to medicines. Therefore, for instance, traders working in the synthetic resins business would need to factor in crude oil price volatility.

The forces behind the fluctuations and how to face them

The classic supply and demand equation is a vital consideration for every trading company. When demand rises for fuels and everyday products that rely on crude oil, putting pressure on supply, prices can be expected to go up. For instance, October’s multi-year crude oil price highs were driven by tight supply and rising demand as social distancing guidelines relaxed globally.

Conversely, we saw a sharp dip in crude oil prices last year when the pandemic forced many people to enter lockdowns. And again more recently, the emergence of COVID-19’s Omicron variant caused crude oil prices to tumble. It’s clear then that consumer behavior has a tremendous effect on crude oil prices, which in turn affect consumer sentiment as higher crude oil costs raise overall inflation expectations.

Because of the risks associated with oil shocks, when prices rise while economic growth stagnates, supply becomes an important tool for maintaining control over crude oil costs. For example, we regularly see how oil-producing nations can control supply to affect crude oil prices, with the recent U.S. release of 50 million barrels of oil from its reserves being an attempt to bring down prices.

Samsung C&T’s role in stabilizing the rollercoaster

While there isn’t a lot that a trading company can do to prevent pandemics and political upheaval, traders can work to anticipate global price variations and strengthen supply chains in order to minimize the impact of market shocks.

Samsung C&T Trading & Investment Group gathers intelligence and acts upon it via offices based across the world. This is particularly important because the company works with various petrochemicals, trading them directly and finding solutions for suppliers and end-users.

Interestingly, according to the International Energy Agency, petrochemicals will account for one-third of the world’s crude oil use by 2030 due to increased demand for petrochemical products, which will then be set to become a bigger driver of global crude oil demand than fuels. So, Samsung C&T will continue to pay close attention to changes in crude oil prices, acting accordingly across the company’s global trading network.