At a glance

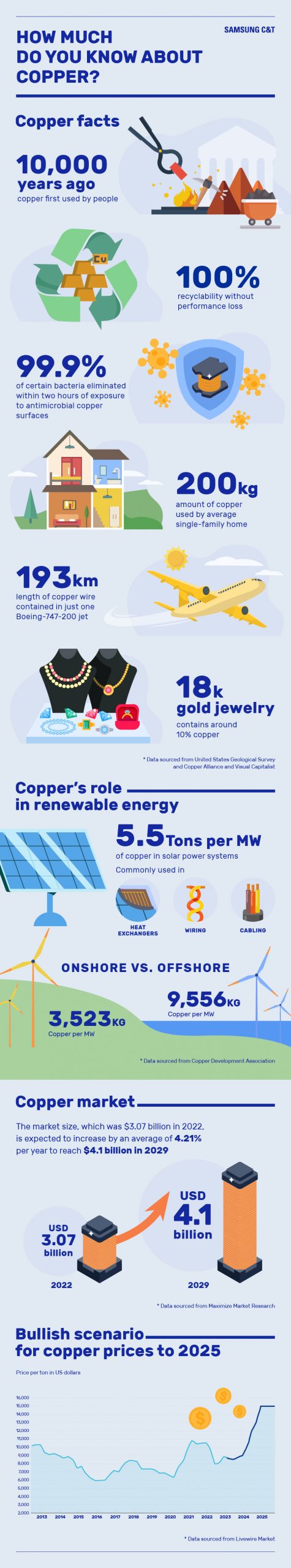

- Copper has been used by people since around 8000 B.C., and its applications continue to expand

- A bullish estimate suggests that the price of copper could nearly double by 2025

- Samsung C&T performs various roles in the copper business, in which it has operated since 1981

There are at least two reasons why our commodity in focus for this article is accurately nicknamed “Dr. Copper.” First, it’s seen as an indicator of global economic health because copper is vital to industries such as construction and the manufacturing of electronic products – meaning that demand for copper will be strong when those industries are doing well.

But copper is also renowned for its role in the medical field due to antimicrobial properties that allow it to be used for sterilizing wounds and water – indeed, the first recorded medical use of copper was in the Smith Papyrus, written as early as 2600 B.C. Samsung C&T Trading & Investment Group also has a relatively long history working in the copper business, dating back more than 40 years. Let’s find out more about this metal and see how the market’s doing.

From coins to cars

Copper is known as a non-ferrous metal, which means it doesn’t contain iron and is resistant to rust. It has been prized for many other characteristics too, including flexibility, heat and electrical conductivity, and those antimicrobial properties.

Given its various benefits, it is not surprising that copper has been used by people for a range of applications – starting with making coins and ornaments around 8000 B.C. Copper even helped usher in the improved tools of the Bronze Age from around 3000 B.C. – bronze is what you get when you alloy copper with tin.

In our current age of electronics and sprawling urbanization, copper has found many more uses in applications such as electrical wiring, roofing, heating, and plumbing. You can find copper in everything from smartphones to jet aircraft! And as the world transitions towards cleaner energy, copper is seen as a critical component in electric vehicles as well as solar and wind power generation. Take a look at the facts below to get an idea of where copper ends up and why its status is only expanding.

Where does Samsung C&T come in?

Copper has been fueling optimism, with the market’s size expected to expand to US$4.1 billion by 2029, as shown above. To look at it another way, a bullish forecast for copper prices indicates a jump from this year’s low of just over US$8,000 per metric ton to US$15,000 per metric ton in 2025.

Samsung C&T continues to be active in the copper business, while strengthening its foundation for sustainable growth by securing stable profits based on its trading capabilities. With a history dating back to 1981, the company’s copper business activities include purchase, local logistics, and customized sourcing to end-users.

For example, Samsung C&T has managed to secure a stable copper cathode supply from Africa and identified demand in China and South Korea as well as Southeast Asia. Note that copper cathode may be high as 99.95% pure copper – Samsung C&T also trades the relatively raw form of copper concentrates, which it sources from Canada, Chile, Mexico, Mongolia, and Peru. Its supply of these ensures smelters in China, Europe, and South Korea have a stable supply of optimal grade concentrates. And we can expect demand to grow further as the global energy and electric mobility transition accelerates.