We kicked off our 2024 key commodity outlook by assessing this year’s expectations for steel, copper, rechargeable battery materials, and precious metals. In doing so, we presented a mixed picture of opportunities and challenges, as global economic uncertainty weighs on many commodities.

Continuing with the second part of our outlook, we will now look at various forms of energy and fertilizer, which may be affected by factors ranging from geopolitical concerns to the worldwide transition away from fossil fuels. Moreover, post-pandemic energy consumption is set to grow 1.8% in 2024, up from 1.2% last year, according to economic and political analysis provider Economist Intelligence Unit (EIU).

As we did in the first part of our outlook, we will also explain where Samsung C&T Trading & Investment Group’s business interests come in.

Crude oil

Crude oil, which remains such a vital commodity around the world despite pressure to reduce fossil fuels, is caught in a battle between supply and demand.

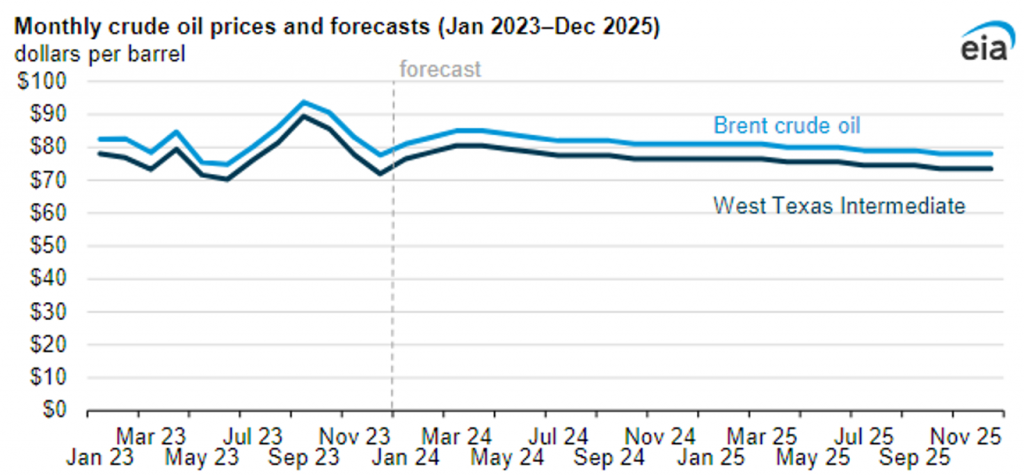

According to Goldman Sachs, supply of crude oil will be “surprisingly ample” this year. Continued robust supply from non-OPEC nations suggests “softer” crude oil prices, based on this analysis. On the other hand, S&P Global cites OPEC’s expectation that increased non-OPEC supply will be significantly outpaced by demand over the next two years, as OPEC nations maintain “aggressive supply cuts.”

If we look at some figures, the International Energy Agency (IEA) recently revised up its global oil demand forecast to 1.24 million barrels per day (bpd) this year, which is behind OPEC’s forecast of 2.25 million bpd – and the IEA sees Brent crude oil at US$82.57 per barrel in 2024 compared with Goldman Sachs’ view of US$80-81.

Fertilizer

Fertilizer prices have been strongly linked with global conflicts and other economic disruptions. They eased last year after soaring to record levels in 2022 following the outbreak of war in Ukraine. But this year, ongoing geopolitical tensions in regions such as the Red Sea, coupled with China’s trade outlook, mean that the cost of fertilizer will have to be watched closely.

Rabobank, a Dutch multinational banking and financial services company, has issued a positive outlook for nitrogen fertilizer in particular because it is more affordable, and prices are now “floating around historical averages” for ammonia, urea ammonium nitrate, and urea. Meanwhile, leading credit rating agency Fitch Ratings forecasts higher-than-expected prices for various fertilizer commodities, including ammonia and urea.

Natural gas

Natural gas has been seen as a particularly important geopolitical commodity in recent years. Just as fertilizer is vital for food supply, gas keeps many homes warm during cold winters among other applications.

Despite heightened geopolitical uncertainty, natural gas is on course for greater demand in 2024 on the back of lower prices, according to the International Energy Agency. Indeed, natural gas prices have fallen 40% in the past three months, while futures were trading just above US$2 per million British Thermal Units earlier this month.

More generally, since spiking in 2022, the price of natural gas has been on a consistently bearish course.

Hydrogen

We have heard and written a lot about hydrogen in recent years. In theory, a source of clean fuel that could transform a number of industries, the cost of hydrogen is still often seen as an obstacle.

Even so, there are differing opinions. This year is set to see progress, according to S&P Global, and developers are reportedly hopeful that support in the form of funding will unlock financing this year.

The difficulty is that among more than 1,000 announced hydrogen projects worth US$320 billion, only 10 percent have been able to secure financial investment. So, global financial institution ING expects hydrogen growth in 2024, but “less than many had hoped for” with green hydrogen struggling to be cost competitive and its prices are particularly prohibitive in Europe.

Renewables

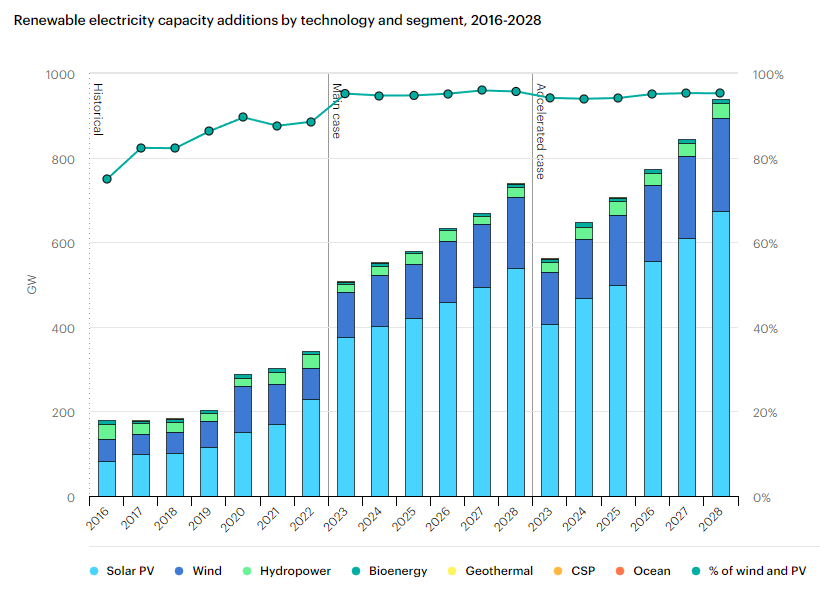

The flip side of the aforementioned transition away from fossil fuels is the rise of renewable energy options such as solar and wind power.

It should not be surprising then that the EIU expects demand for renewable energy to jump by 11% this year. As well as decarbonization efforts, energy insecurity has driven governments to speed up their plans to deploy renewables.

With solar power now maturing in its evolution, according to research company Wood Mackenzie, it will “shift from high growth to a slower-growing, mature industry in 2024.” The industry saw around 1.5 TW of capacity installed in 2023, while another 3 TW is set to be added in the next decade – making it a “cornerstone of the global energy transition.” Meanwhile, the global wind energy market is set for a long-awaited recovery this year after the market surpassed 1 TW of installed capacity in 2023.

Where does Samsung C&T come in?

This Newsroom previously highlighted the crude oil price roller coaster and its impact as well as the rise and rise of petrochemicals and their importance to the crude oil industry. Samsung C&T works with various petrochemicals, trading them directly and finding solutions for suppliers and end-users.

The company is also currently accelerating the growth of its fertilizer business, which dates back to the 1970s, including by expanding target regions and products for sales while strengthening its customer pool.

Regarding clean energy sources, the company continues to make efforts to strengthen partnerships with competent counterparts in the green hydrogen field. It is additionally strengthening its eco-friendly business portfolio in the area of renewables, having developed solar and wind energy projects in North America before broadening its focus to Australia.

Hopefully, we now have a good overview of how numerous commodities and energy sources are expected to fare in 2024. Of course, Samsung C&T traders will be watching for every possible shift in markets within and outside of expectations while playing their part to bolster trade and strengthen supply chains.