A lot is written about hydrogen these days. While hopes are rising that it can be one of the world’s most important energy solutions, there are also questions about how practical that is.

What’s interesting is that we could be set to witness a shift in hydrogen’s primary usage from industrial applications to mobility as global clean hydrogen demand is expected “to grow significantly to 2050.” This trend is viewed positively by the International Energy Agency (IEA) and other organizations that favor hydrogen-powered vehicles over gasoline and diesel counterparts because the former produce zero emissions, leaving only water behind.

But if that is to happen, it is vital for there to be an adequate infrastructure in place so that drivers can keep their hydrogen vehicles in operation. A particularly important practical consideration is that there should be enough hydrogen fueling stations to meet demand.

Let’s find out how likely this is to be achieved as we get inside and beyond the market for hydrogen fueling stations.

What exactly is a hydrogen fueling station?

Hydrogen fueling stations work in a very similar way to gasoline and diesel options, with drivers pulling into a station to place a fuel nozzle in their car and filling up in around the same amount of time. Yet there are significant differences because hydrogen is not a fossil fuel but rather is in the air and water all around us.

After it has been produced, ideally using renewable energy to generate “green hydrogen” through electrolysis of water, hydrogen gas is typically transported to fueling stations in a compressed form to increase storage capacity.

In some cases, hydrogen may be produced and supplied directly from the fueling station site — either way, safety measures are vital to ensure the safe storage and delivery of hydrogen to vehicles, including features such as leak detectors, automatic shutoff valves, and ventilation systems.

Once the hydrogen fuel nozzle is attached, the gas is transferred to the vehicle in order to provide power via a hydrogen fuel cell, which we explained in more detail previously.

Plus points and challenges surrounding hydrogen fueling stations

The viability of hydrogen vehicles has been a matter of debate, thus raising some uncertainty about the market for hydrogen fueling stations.

Critics point out that fueling hydrogen vehicles is less efficient than electric vehicles (EVs) because it is more efficient to use energy to directly charge the latter. But it does not have to be a case of choosing either EVs or hydrogen vehicles — the IEA’s target, for instance, is for hydrogen to account for 16% of road transport by 2050.

Moreover, hydrogen fuel cells are generally lighter than EV batteries and require a lot less time to refuel than to charge up an EV, making them a more practical choice for heavier vehicles such as buses and trucks.

Not that cars are out of the picture, as one major car manufacturer is seeking to make 100,000 hydrogen vehicles per year by 2030 in anticipation of this technology making up as much as 40 percent of the commercial vehicle market. Another recent report noted demand for hydrogen vehicles in Canada but also made the point that there need to be enough hydrogen fueling stations to accompany them.

In terms of cost, building a hydrogen fueling station requires an estimated US$2-3.2 million, with gas storage stations being less expensive than liquid delivery ones and those that produce their own hydrogen.

A rising market opportunity

While there have been government subsidies to encourage hydrogen mobility in various global markets, there is still much infrastructure to be built – in Europe, for instance, there are reportedly just 178 hydrogen fueling stations, while the U.K. has only nine.

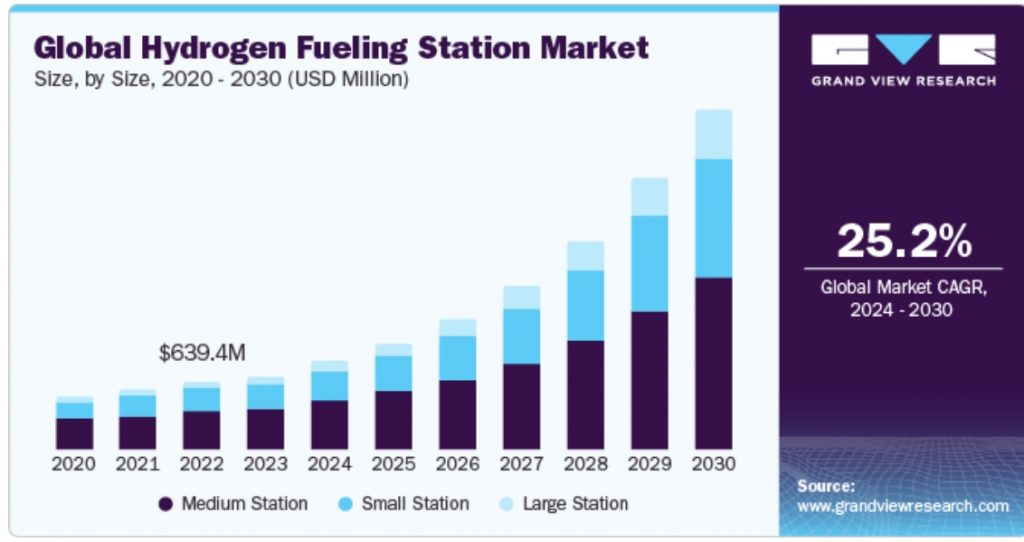

The ambition being shown by governments is reflected by a strong outlook for the global hydrogen fueling station market. Having stood at an estimated US$695 million in 2023, it is forecast to grow at a CAGR of 25.2 percent from this year to 2030.

Samsung C&T Trading & Investment Group has been working to bolster the clean hydrogen value chain, such as by strengthening partnerships with competent companies in each value chain in the green hydrogen field to introduce and utilize overseas clean hydrogen.

It has also been investing in the construction of hydrogen fueling stations to supply buses in Korea, which is one of the world’s most advanced hydrogen vehicle markets.

Soon, however, it looks like Korea will no longer be a rarity in that respect. According to the global outlook, hydrogen fueling stations will become a fairly common site across the world in the foreseeable future.